In 2019, the S&P 500 (NYSEARCA: VOO) made gains of 28.9%, its best run since 2013's 29.6% rally. It was a year of unprecedented bullishness on top of a decade that did not experience a single day of recession. This set up a scenario which saw tech experience massive growth, leading to these companies achieving a never-before-seen level of dominance in the index: Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), and Facebook (NASDAQ: FB).

1. Apple

Amongst the 505 stocks that comprise the S&P 500 index, Apple was solely responsible for 8.2% of the market's total 2019 gains. Having led the way as the best-performing Big Tech stock of the year with gains of 86.2%, the iPhone maker has not lost any momentum despite declining iPhone sales around the world.

As the most valuable company in the U.S., Apple has been on a good run so far in 2020. However, Apple also crossed the threshold of 4% weighting in the S&P 500 for the sixth time and, historically, Apple has gone on to underperform in the following quarters each time this has happened. Only Apple, Microsoft, General Electric (NYSE: GE), Cisco (NASDAQ: CSCO), and Exxon Mobil (NYSE: XOM) have ever surpassed 4%, and they rarely stay there longer than a few months.

2. Microsoft

Microsoft was second to Apple in the top contributors to the S&P 500 last year, accounting for 6.6% of the market's gains, and like Apple, also breached the 4% mark once again for weighting at 4.55%. The tech giant's stock itself rose more than 55% in 2019 and has been on a rally since the start of 2020.

As one of the select few companies to receive a market cap of more than $1 trillion, Microsoft is now worth more than it ever was. The company has significant market dominance over the competition in its core software products, while its cloud segment, 'Azure', has become a major competitor to the dominant 'Amazon Web Service', and its 'Teams' collaboration product has put companies like Slack (NYSE: WORK) on the back foot.

3. Amazon

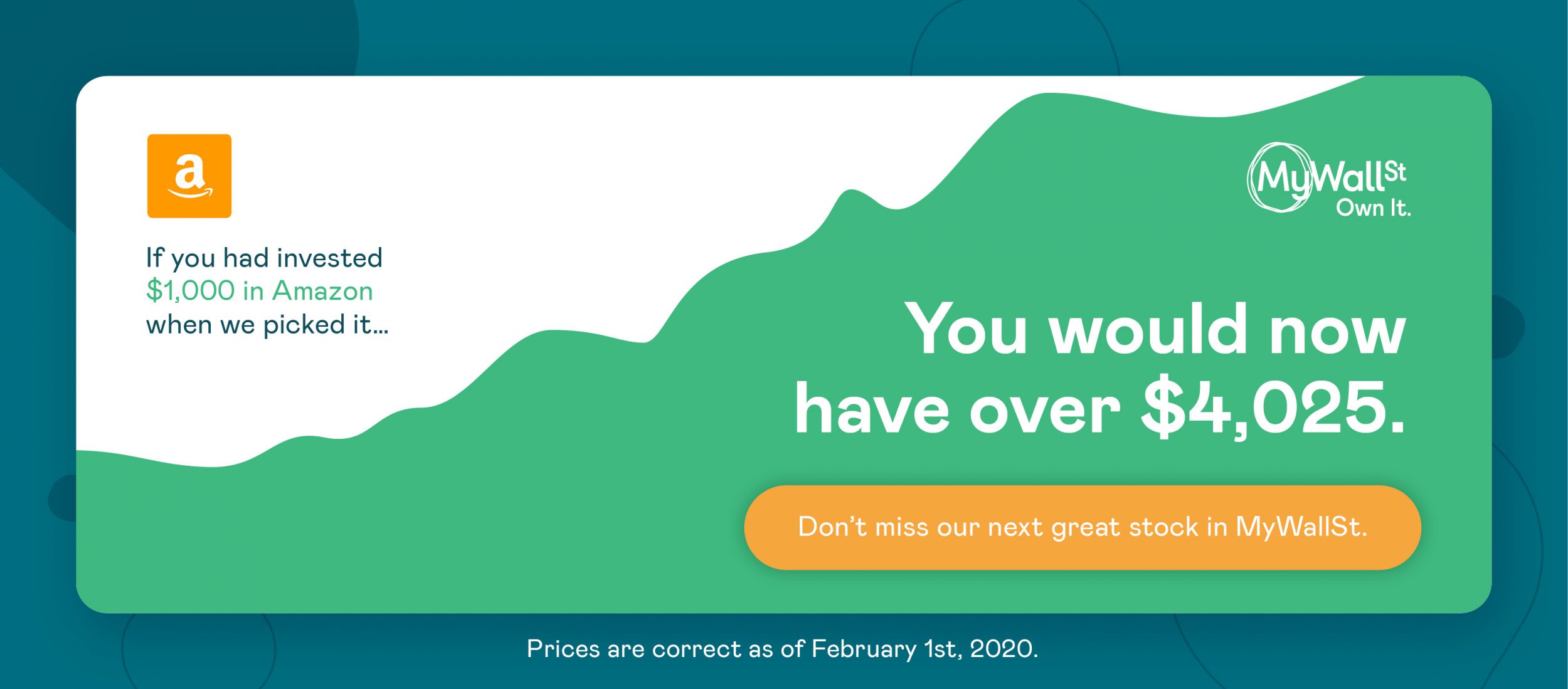

Another one-time member of the trillion-dollar club, Amazon has grown to become one of the most diversified and powerful companies on the planet. What started off as a bookstore is now a multinational conglomerate mega-brand that contributed to nearly 3% of the S&P's 2019 growth.

Jeff Bezos' empire has grown to become the world's largest online store with roughly 40% U.S. e-commerce market share, which still leaves plenty of room for growth. However, that is but one part of its overall business now, which includes cloud services, digital advertising, groceries, and prescription drugs, artificial intelligence, music, and media streaming. Its cloud segment is becoming a massive revenue generator, while its e-commerce platform is still holding off advances from competitors such as Shopify (NYSE: SHOP) and Alibaba (NYSE: BABA).

4. Alphabet

Google's parent company is one of the most recognizable companies in the world and just recently became the latest member of the trillion-dollar club, with a market cap of $1.02 trillion as of January 21st, 2020. The internet search giant was responsible for 3% of the S&P's gains last year and holds a weighting of more than 3% when combined with Class A, and Class B shares, just short of Microsoft and Apple.

Alphabet just appointed long-time company loyalist Sundar Pichai as the company's new CEO, replacing founders Larry Page and Sergey Brin. Under Pichai's leadership as CEO of Google since 2015, the company has become the dominant force in online advertising, as well as revitalized the handheld hardware 'Pixel' program. Stock growth has been steady in recent years, if not in line with the S&P itself, but Alphabet has a thriving business that dabbles in a lot more than search engines, including the likes of AI, hardware, energy, automated vehicles, cloud, and much more. There is still a lot of space to grow.

5. Facebook

Certainly, one of the most controversial companies in the world, Mark Zuckerberg's social network rounds up the biggest stocks from the S&P 500 last year, with a weighting of just under 2%. Facebook contributed to nearly 3% of the index's gains, despite being the lowest valued on the list.

The stock has been hovering around record highs since the start of the year, but the FAANG stock has been in an investor tug-of-war for the past 18 months between bulls focused on strong operating results and bears looking at the company's dubious practices. After a 44% dive following its July 2018 peak, the company is recovering well, with its ad business growing, and revenue jumping 29% in its latest earnings report. The same threats of antitrust facing Facebook are faced by every company on this list, but it hasn't stopped them from being among the most successful companies on the planet.

If you enjoyed this, you will love these related articles:

- Facebook CEO Mark Zuckerberg: Investor Breakdown

- Apple And Microsoft's Strongest Year

- Apple, Google, and Amazon Team Up To Create Smart-Home Standard

MyWallSt operates a full disclosure policy. MyWallSt staff currently hold long positions in Alphabet, Amazon, Apple, Facebook, Shopify, Slack, and Microsoft. Read our full disclosure policy here.

- New stock picked every week out of 60,000 worldwide

- Ten Foundational stocks to hold until 2034

- A library of 60 stocks with analysis

- 10 year Track record of performance