The seams appear to be unraveling at Google in 2019, but there is a lot of evidence to suggest that the culture at Alphabet's (NASDAQ: GOOGL) primary subsidiary has been turning sour for quite some time now. This has led to the company's stock jumping up and down throughout 2019.

Is it possible that the company which once had "Don't Be Evil" as its unofficial motto for years, could, in fact, be turning into a business with a toxic culture? Let's explore the evidence.

Culture of mistrust

Google has consistently been considered among the top companies to work for throughout the years, regularly topping charts that include the likes of Big Tech rivals Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), and Microsoft (NASDAQ: MSFT).

Then why are there so many more stories of mistrust and poor employee relations at Google than at these other giants? Aside from a string of sexual harassment suits -- which is discussed in the next paragraph -- there is a deeper problem of mistrust among staff against upper management. This was made evident earlier in November when it was revealed that Google would no longer hold weekly all-hands meetings amid growing workplace tensions.

CEO Sundar Pichai reportedly sent an email to employees canceling its famous TGIF weekly meetings due to dwindling attendance and a number of leaks of company information to the media by employees. The weekly meeting was a tradition that spanned from the company's founding. This followed a new summer policy that banned political discussions in the office, with Pichai citing that the company was "genuinely struggling" with employee trust.

A true flashpoint occurred just prior to the cancellation of TGIF, when Google employees in San Francisco staged a protest following the firing of two employees, who had been subject to a 2.5-hour interrogation by management over potential leaks. This was not the first protest at Google in the past year...

Sexual misconduct and the diversity problem

Last year, a protest was staged by Google employees in protest of a $35 million payout given to former search executive Amit Singhal, who was forced to resign due to sexual assault allegations. This is not the first instance of this at Google, with several incidents reported throughout the past decade, such as the 2014 Andy Rubin case, who it was revealed earlier this year, received a $90 million severance package.

In March of this year, Alphabet's board of directors was then accused by shareholders of covering up a number of sexual misconduct cases and allowing a culture of sexually predatory behavior to exist in the company.

These lawsuits later culminated in a full-blown investigation against Google executives, leading to Alphabet hiring an outside firm to examine the extent of these sexual misconduct allegations.

Not only must Google contend with this issue, but it also has an issue of not reaching diversity standards. Google's leadership is 74.5% male and 66.9% white, with little increase in the years since these statistics began recording in 2014, falling below some of its biggest rivals in Big Tech -- Apple is 68% male, and under 60% white: not an amazing statistic, but better.

With so many suits ongoing, these issues could drag out over many years for Google, which will have seen its reputation tarnished even further by that point. Alphabet may be the king of cash, but much of that is going to be tied up in legal fees for quite some time.

Antitrust woes

No more important than sexual misconduct and poor company culture, but antitrust is an issue that can hurt Google the most.

The most concerning investigation by antitrust regulators is an ongoing look into the company's 'monopolistic behavior' by 50 attorneys general in the U.S. The investigation will look at alleged accusations of Google deliberately harming small businesses' searchability on its search engine.

Though antitrust fines have been minuscule when compared to the wealth which Alphabet possesses, the fines have been growing, and if found guilty, Google could be in for a big shock, especially with so much talk of breaking up Big Tech due to its monopoly.

This culture of mistrust has spilled into the consumer sphere also, as is evidenced in reports that thousands of Fitbit users are considering getting rid of their devices because they don't trust Google. If consumers begin to start wising up to Google and lose faith in it completely, this will hurt its revenue. Though I do not see this happening any time soon, a large lawsuit from antitrust that depicts Google in an even worse light could prove very damaging to an already fragile image.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in Alphabet Inc, Amazon, Apple, and Microsoft. Read our full disclosure policy here.

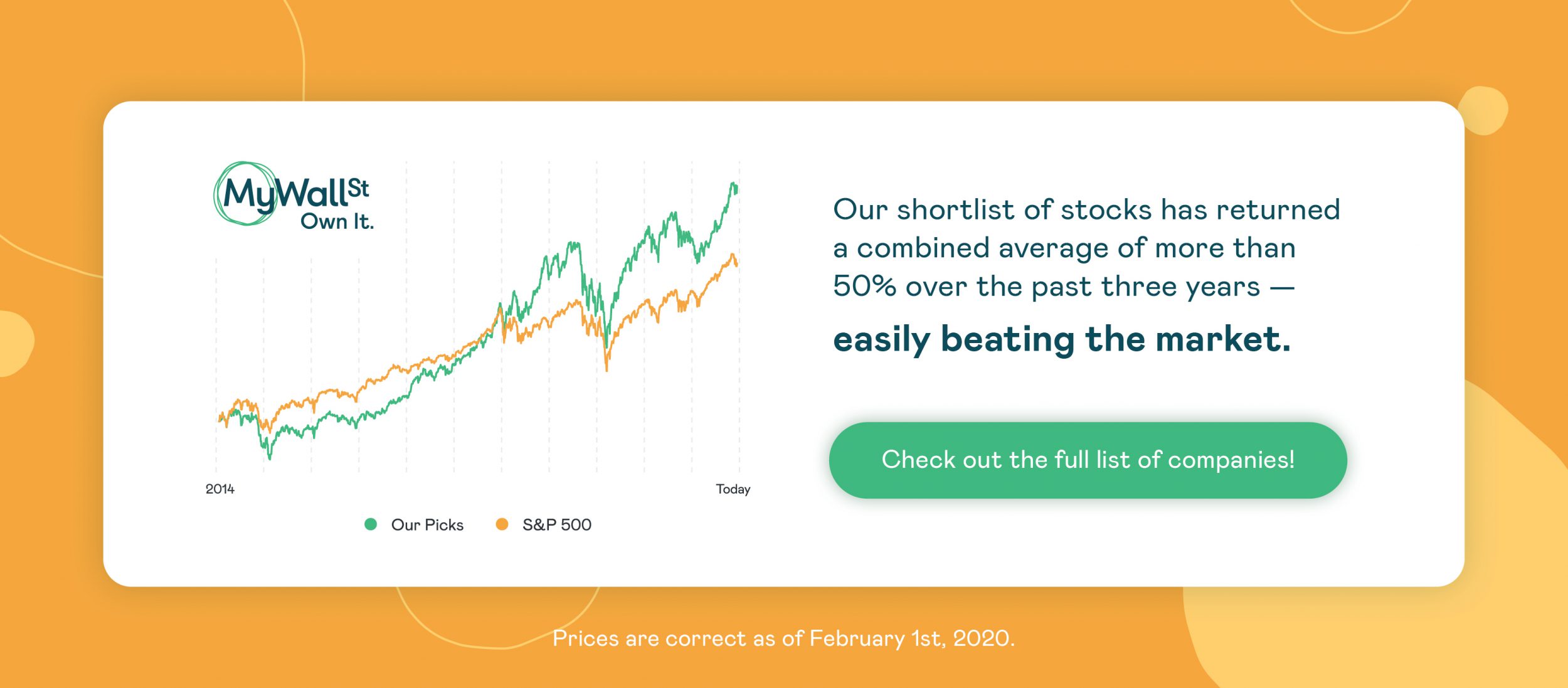

- New stock picked every week out of 60,000 worldwide

- Ten Foundational stocks to hold until 2034

- A library of 60 stocks with analysis

- 10 year Track record of performance