3 ESG Stocks To Buy Right Now

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

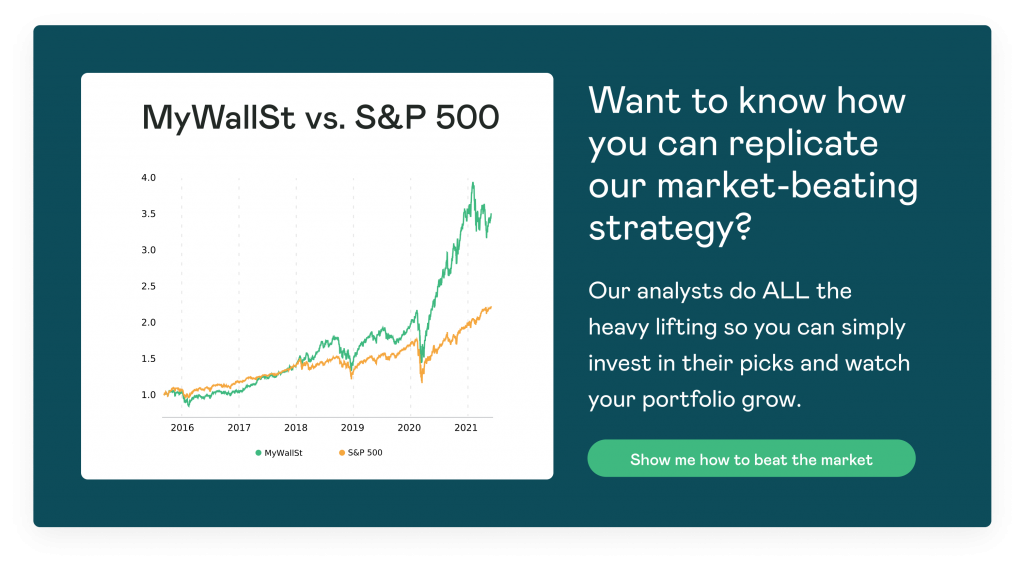

- Proven Success: 10-year track record of outperforming the market.

Everyone wants to live in a nicer world, and if that means investing in businesses that support responsible living, then so be it. The popularity of environmental, social, and governance (ESG) practices has really taken off in recent years and shareholders are becoming increasingly aware of the way in which the companies they invest in are run.

The proof is in the finances too. A report found that in the first 12 months of the pandemic, investment funds with ESG criteria outperformed the broader market. In that time frame, S&P Global Market Intelligence found that out of 26 ESG funds, 19 performed better than the S&P 500. These ESG funds increased between 27.3% and 55% over that year compared to the S&P 500's 27% gain.

So not only are ESG stocks beneficial for the world but they also seem to be good on the pocket too.

What ESG stocks should I buy?

1. AstraZeneca

AstraZeneca (LON: AZN) is a British and Swedish-owned pharmaceutical and biotechnology company that is headquartered in Cambridge, England. This firm has made great progress on its environmental initiatives. Over the past 6 years, Astra has successfully reduced its greenhouse gas emissions by 60% and water usage by 20%. In addition, AstraZeneca is also planning to reduce energy and water usage further and minimize waste in the years ahead.

Not only has AstraZeneca made some impressive advancements in its environmental practices, but the company also scores highly for other ESG actions. For example, its medicines have positively affected society by producing vaccines during the pandemic which has helped save lives. Critics have noted that Astra made an admirable contribution to the world when it decided to supply governments with its COVID-19 jab at cost price.

2. Equinor

Equinor (NYSE: EQNR) is another company that ranks highly for ESG. Equinor is a Norwegian state-owned energy firm that operates primarily as a petroleum company. You may be thinking what is a fossil fuels company doing on the list but it deserves a lot of praise.

According to the company, it has made a strong move into renewable energy and is targeting to increase its green actions tenfold by 2026. Equinor is also planning to build a global offshore wind power provider. All these moves prove that the firm is moving with the times and is trying to make the world a better place.

If those plans weren't enough, Equinor's is based in Norway, a country famous for its environmental initiatives. The Norweigan government gives out lots of incentives to its people to go electric. This logic seems to have resonated with Equinor and many believe the company is in the perfect location to go greener.

3. Lucid Motors Group

Lucid Motors Group (NASDAQ: LCID) is a U.S.-based EV manufacturer that also has divisions in energy storage and equipment manufacturing. Lucid is a newly formed company that was made when Churchill Capital Corp and Lucid Motors merged in a SPAC deal. While investing in SPACs can be a risky business, this stock looks like a good ESG play.

While Lucid is known for being dubbed as 'The Next Tesla', it also scores highly on the ESG spectrum for going after the higher income bracket in its pursuit to persuade more car buyers to go electric. While this may sound like it's about making more revenue for the company, nevertheless, convincing wealthy people to dump their fossil fuel-guzzling motors is still an important environmental mission.

Building luxury, high-quality vehicles should turn more people to buying EVs, which is great news for the environment. If Lucid is successful in attracting the upper class, rich folk to go green, the stock is looking like a worthy ESG investment.

Do not miss out on investing in the growing EV market. Luckily, MyWallSt's got a shortlist of market-beating stocks in all industries so you can accumulate long-term wealth. Simply click here for free access today.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.