3 Stocks to Invest in During the Holiday Season

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

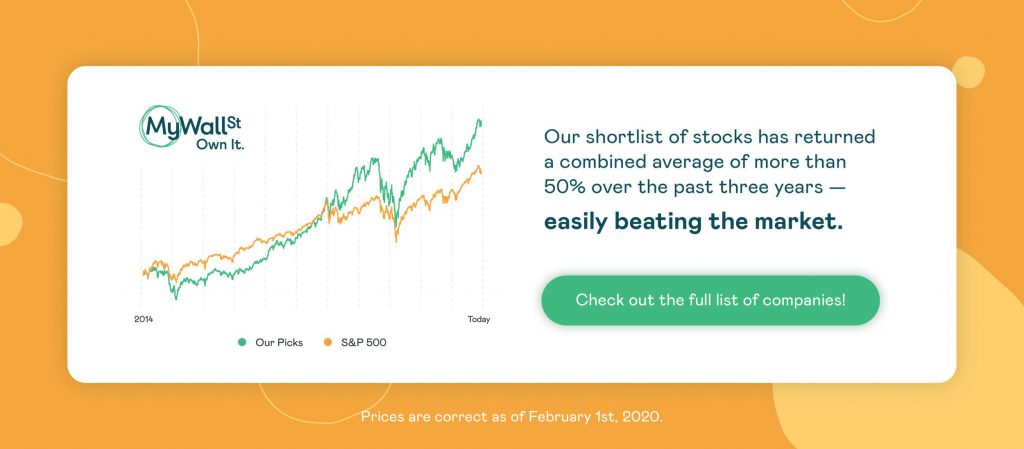

- Proven Success: 10-year track record of outperforming the market.

There are some terribly annoying people who have completed their holiday shopping already this year and can sit back and laugh at the rest of us frantically running from store to store.

However, it is us disorganized slow-pokes who may well create a hefty profit for these 3 companies below during the mad holiday shopping scramble. These companies have traditionally thrived over the festive period, and look set to do so once more. As well as this, they appear to have big plans going into the new year, which may continue to drive their stock price up over the coming 12 months. Instead of looking at the usual big players such as Amazon (NASDAQ: AMZN) or Apple (NASDAQ: AAPL), we decided to bring you some stocks you might not have thought of.

Etsy

Over the years, Amazon has been the main point-of-call for holiday shoppers, but what about those looking for something a bit more niche?

Step forward Etsy (NASDAQ: ETSY).

Most items that are advertised on Amazon can be purchased elsewhere, either online or at brick-and-mortar stores. People choose Amazon because it's fast, convenient, and reliable. Etsy aims to be the place where you buy items you can't find anywhere else. When Amazon launched 'Handmade' in 2015 to compete, Etsy's stock fell 75% and then proceeded to thrive -- sellers didn't abandon Etsy for the bigger rival and shoppers continued to turn to Etsy first.

In the first half of this year, Etsy grew its active sellers and buyers 18% and 19% year-over-year, respectively, while revenue grew by 20%. With sales looking set to get yet another boost over the holiday season and analysts expecting revenue to improve by a further 33% this year, Etsy might just be a great investment.

Lululemon

One of the surviving members of the ongoing 'retail apocalypse', Lululemon (NASDAQ: LULU) is in a league of its own when it comes to athleisure apparel. Not only has it survived the recent slew of bankruptcies crippling the apparel sector, it has thrived.

The stock has grown just short of 400% in the past 5 years and is up more than 80% in the past year alone. The yoga clothing manufacturer has repeatedly been churning out double-digit growth while opening new stores and expanding its gross margins.

The holiday season alone has been a big money-maker for Lululemon, with revenue in its fourth-quarter 2018 rising $1.17 billion from $928 million a year before. This year Lululemon is estimated to bring in more than $1.2 billion in the same period. With plans to double its digital and men's apparel revenue, as well as global expansion between now and 2023, Lululemon is the stock(ing) you want to hang over the fireplace this year.

Shopify

A staple of many communities is the small business, and what do small businesses use to sell their goods online? Shopify (NYSE: SHOP).

The Canadian tech company has been a thorn in the side of the likes of Amazon and Mercado Libre (NASDAQ: MELI) since its inception, going public in May 2015. In the four years since, Shopify has seen its stock rise more than 1,200% -- our most successful stock pick to date here at MyWallSt. The company has made itself a 'one-stop-shop' for businesses who wish to create their online stores, manage transactions, build marketing campaigns, and more.

Demand for Shopify is still growing, and they now serve over 800,000 merchants, many of whom are smaller businesses that otherwise may lack the necessary firepower to use the larger firms.

Last year, Shopify reported hundreds of signups to its Shopify Plus premium service ahead of the holidays, and this trend is expected to be repeated this year, which has led to Wall Street analysts forecasting Shopify's earnings to grow by 61% this year.

It seems that holiday cheer has been prevalent at Shopify for several years now, and long may it last.

MyWallSt operates a full disclosure policy. MyWallSt staff currently hold long positions in all companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.