3 Stocks To Play The Green Boom

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

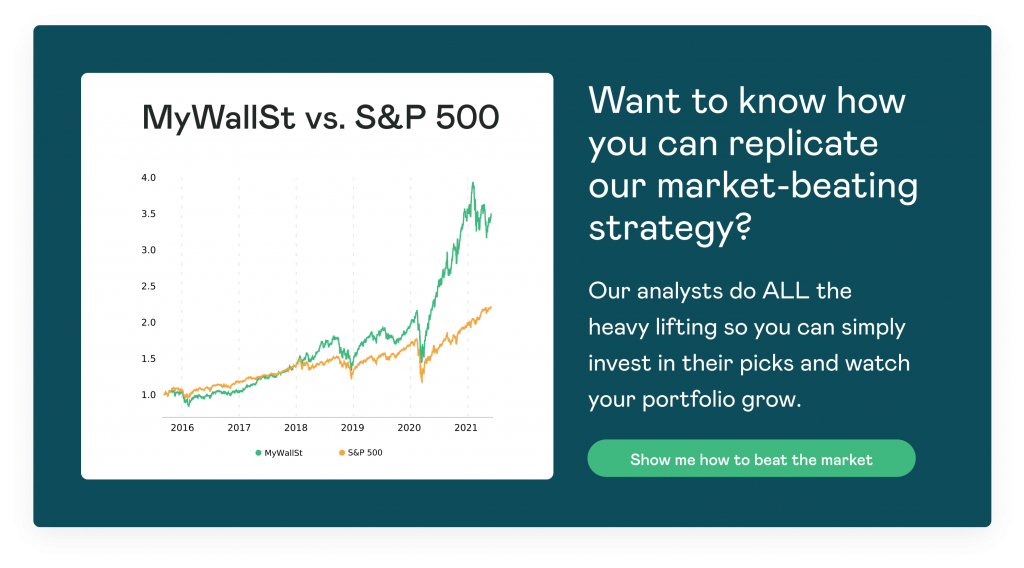

- Proven Success: 10-year track record of outperforming the market.

Sustainable investing is all the rage right now. Investors do not only want a portfolio that is in the green but also one that is green for the planet too.

We all know that we need to play our part in saving the environment and if we can make some green along the way, all the better. You've already heard about how industry giants like Tesla (NASDAQ: TSLA) are playing the green energy trend but you should also note these other rising companies in the sustainable sector.

Without further ado, let's see what stocks are the top green companies across the solar, electric vehicle (EV), and infrastructure industries.

1. Clearway Energy

Clearway Energy (NYSE: CWEN.A) is a developer of renewable energy projects which help companies and consumers adopt green practices. The firm has solar and wind assets in 25 states in the U.S. and is backed by Global Infrastructure Partners, one of the largest infrastructure investors in the world.

Clearway Energy has a 'community solar' farm, which takes the hassle away from people having to install their own solar panels. Subscribers support solar power projects in their community and the energy is then sent to their local power grids. Clearway does not send power directly to its customers but instead gives them energy credits that lower their utility bills.

Shares of Clearway Energy are up 13% over the past 12 months. The company also brought in $1.2 billion in revenue last year and $237 million for the first quarter of 2021. In addition, Clearway pays a dividend of 4.9% to its shareholders making this a very attractive stock for investors.

2. Ford

One of the oldest auto manufacturers in the world, Ford (NYSE: F), is betting big on green after seeing the EV trend kick off over the past few years. Back in May, the company introduced its new Ford+ plan.

The plan is for 40% of Ford's vehicles to be energy powered by 2030 and to aid this, it is going to raise its total spending on electrification to over $30 billion by 2025, including investments in battery technology and production.

This goal will be driven by the launch of its F-150 Lightning pickup which is set to go on sale in 2022 and the Mustang Mach-E, which is currently on the market. The Detroit-based company reported at the end of April that it sold 7,000 Mustang Mach-E models, with 70% of these buyers being first-time Ford customers, proving that its EV efforts are introducing the firm to a wider audience. Furthermore, Ford's E-transit commercial vans will hit dealerships later this year.

Shares in Ford are up almost 70% year-to-date and many expect its share price to boost again once these new EV models are released.

3. SolarEdge Technologies

SolarEdge Technologies (NASDAQ: SEDG) is one of the world's largest designers and makers of solar inverters which convert renewable energies used by appliances and other electronics. The company has recently entered into partnerships and delivered powertrain kits in Europe, making the stock look promising.

Furthermore, U.S. President Joe Biden's infrastructure plan investment will encourage the use of renewable energy and move the country away from fossil fuels which should result in the solar industry getting a nice boost. Great news for SolarEdge.

Despite these plans, SolarEdge has failed to grow its revenues and profitability due to supply-chain issues resulting in its total residential shipments declining over 10% year-over-year in Q1. However, by the end of the first quarter, its total assets of $2.5 billion were almost double its entire debt of $1.4 billion meaning the company still has lots of cash to expand into new markets. This stock might be a long play but still has the potential to become a great green investment.

Read more about Green Energy:

3 Green Energy Stocks For The Income-Seeking Investor

2 Stocks Investors Should Buy Now For A Greener Future

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.