How Does Amazon Make Money?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

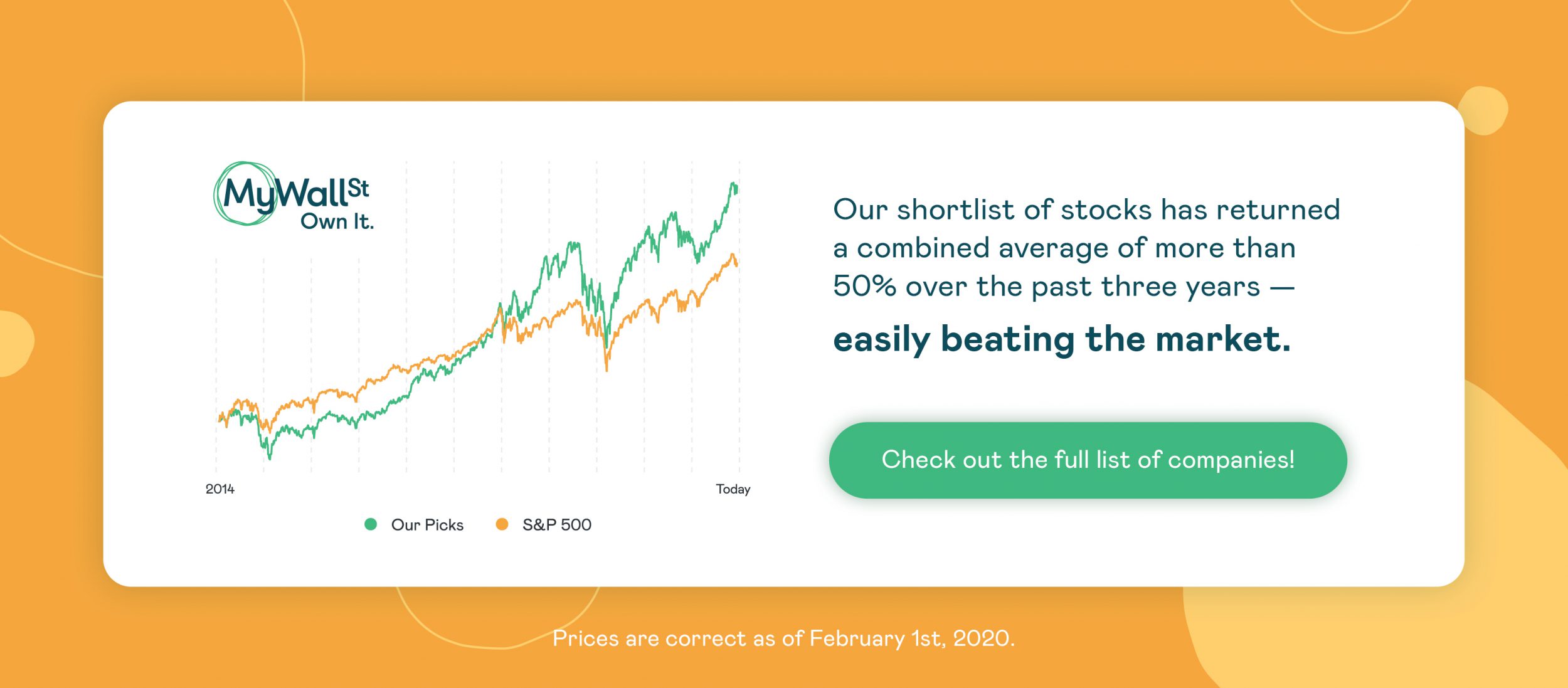

- Proven Success: 10-year track record of outperforming the market.

If you are in need of last-minute shopping, you will be familiar with Amazon (NASDAQ: AMZN) -- the world's largest retail giant. The fast-growing business was founded by Jeff Bezos in his garage in the mid '90s and stretches itself across e-commerce, cloud services, digital advertising, and groceries. It also offers the 'Alexa' personal assistant and movies on its Amazon Prime Service. Today we're going to find out the answer to the question: how does Amazon make money?

Amazon's Revenue Streams

1. Retail Sales

Despite the company's indent in the e-commerce market, retail sales aren't shipping the large profits some might think they are, and in some cases, Amazon is losing money on its international sales.

In 2018, the retailer bagged 50% of online sales in the United States, generating just over $207 billion in revenue in the U.S and overseas. While Amazon made $7.2 billion in domestic sales, the company lost $2.1 billion on international ones -- meaning Amazon's operating income for its retail sales is around $5 billion out of its total $207 billion in sales.

2. Amazon Web Services

Surprisingly for some, the cloud branch of the company is actually how Amazon makes money. An all-encompassing platform that provides cloud services for companies to store information and generate content. AWS is at the forefront of the cloud services space, controlling almost 30% of the market and generating almost $26 billion in annual revenue. From this, the company pocketed $7 billion in operating income because the cloud services are high-margin businesses that scale well - that's still more than half of Amazon's total profitable income! AWS competes with companies like Microsoft Corporation (NASDAQ: MSFT) and Alphabet Inc.'s Google Cloud (NASDAQ: GOOGL).

3. Advertising Services

Amazon has been aggressively investing in digital advertising services, one of the company's fastest-growing business ventures. In 2018, Amazon reportedly made over $10 billion in advertising sales - that's a 114% increase on the $4.7 billion generated the year before. Its digital advertising is expected to grow by 32.5% in 2020 and 28% the year after. This would make the company a huge competitor to Google and Facebook (NASDAQ: FB), which controls 57.7% of the online ad market in the U.S.

How will Amazon make money in the future?

There are many different projects in the works for Amazon. Most recently the company started screening English football matches as part of its Prime offerings, while in the retail space, Prime customers are being offered free one-day delivery on millions of products. Meanwhile, on its AWS platform, two artificial intelligence services were introduced, 'Contact Lens' for 'Amazon Connect' and 'Amazon Kendra'. Both of the new services assist companies with better insights on business data spread across a number of sources.

The company is expected to experiment with improving its capabilities within retail, services, and advertising in the coming years. For now, the company remains in its prime -- with its third-quarter total sales figure for 2019 up 24% to $70 billion.

MyWallSt operates a full disclosure policy. MyWallSt staff currently hold long positions in Alphabet, Amazon, Facebook, and Microsoft. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.