Is NIU Technologies A Good Buy?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

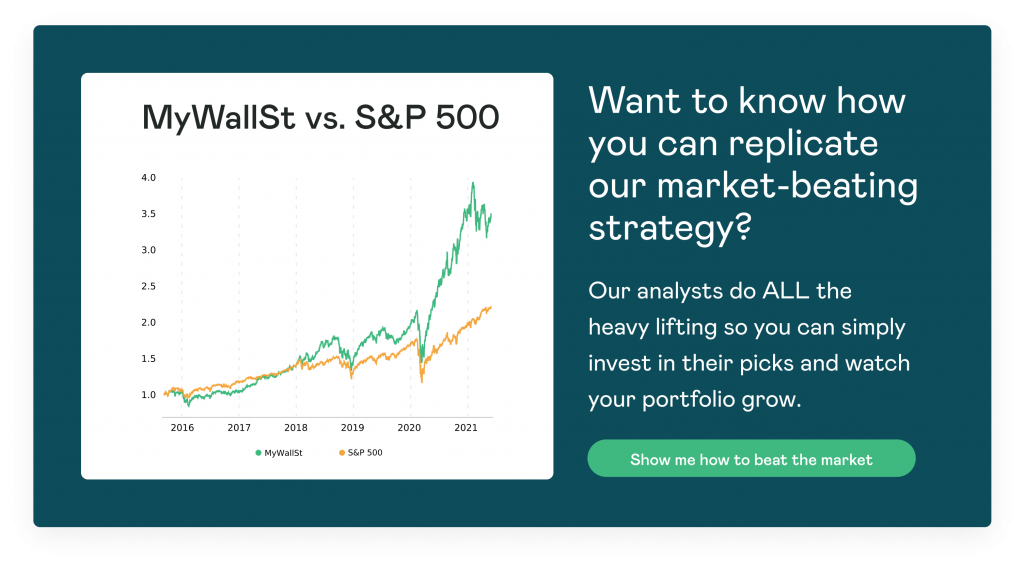

- Proven Success: 10-year track record of outperforming the market.

Niu Technologies (NASDAQ: NIU) is another company focusing on electric vehicles, but this Chinese company, with a name much like the Tesla-competitor NIO, does not seem to focus on cars, but rather, Scooters.

With a fleet of electric scooters and bikes as well as an ambitious aim to revolutionize personal urban mobility, we ask if Niu Technologies is a good investment right now?

The bull case for Niu

During the pandemic, there has been a rise in distrust of public transport with many people looking elsewhere to travel and make small journeys through the busy cities and towns that they live in. As such, Niu has seen a huge rise in demand for its electric scooters with just under 150'000 vehicles sold in the first quarter of this year. The company expects this trend to continue well after the pandemic is gone as personal mobility across urban spaces is much more flexible and open on a scooter, rather than taking the bus.

In addition to the rise in vehicles sold, revenue for the company was up 135% year-over-year (YoY) to $84.6 million for the quarter. In consequence, the number of franchised stores selling Niu products has increased by 300 since December, with a current total of 1,916 stores across China alone.

Between 2021 and 2028, the electric scooter market is expected to grow at a compound annual rate of 29.4% to reach $644.5 billion. This estimation has increased substantially since the beginning of the pandemic. This increase has been encouraged by the demand for short-range personal commuting vehicles that can weave through congestion, as well as increased investment by ride-hailing and food delivery services in the micro-mobility space.

With this industry growth, Niu will have plenty of space to develop into a powerhouse of a company, particularly in China, where micro-mobility is a great solution to the overpopulation of its cities.

The bear case for Niu

Niu's stock is currently down 34% since its peak back in February, and whilst this can be attributed to the wider tech stock sell-off, Niu will have to get used to volatility. Due to the niche nature of the electric scooter industry, Niu will always have some headwinds when it comes to growth. In this regard, investors are likely to be spooked if one quarter does not match expectations or if a new industry trend looks like it can overtake or change Niu's current rate of success. This will all create volatility.

As for breaking out of China, whilst this expansion seems to be going well enough with 39 distributors covering around 48 countries, Niu will need to up its game as there are plenty of competitors on a global scale as well as more locally. The faster this trend grows, the more likely it is that other companies will take the lead. For example, the ever-popular Vespa now has an electric option; it comes in 6 colors and 2 different models.

Whilst this isn't much, it does show similarities to the problems that Tesla is currently facing. Pre-existing companies are now catching onto the EV trend and changing their business practices so that consumers stay with them rather than leave for a new disruptor company. This is something that could happen to Niu further down the line.

So, is Niu a good investment?

Niu is a good buy for now. It has seen a pullback in its share price and as such could be a good opportunity for any investor looking for a bit more of a niche mobility sector to bet on. On the other hand, the company could see serious headwinds in the future as its continued expansion out of China will need to overcome the growing number of competitors in the electric scooter space.

Quickfire Round

- Where is Niu Technologies headquartered?

Founded in 2014, Niu is based in Changzhou, China.

- Who owns Niu Technologies?

Niu's CEO is Yan Li. He has been CEO since 2017

- What does Niu Technologies do?

Niu Technologies offer a range of smart two-wheeled electric vehicles which it designs, manufactures, and then distributes worldwide.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.