Is Olaplex a Worthwhile Investment Right Now?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

This article can be found in the MyWallSt App, alongside an audio companion. Sign up today for a free account and get access to dozens of expertly written articles and analyst opinion pieces every month.

Last September, a haircare company went public with a rather outlandish valuation of around $20 billion. Despite seeing its stock price drop ~40% since then, the business still trades at 21 times sales and 63 times earnings. For context, L'Oreal trades for six times sales and 48 times earnings. So what is this company doing that has investors so willing to pay such crazy multiples for a consumer goods business?

Digging in a little deeper, this business starts to look a lot more like a technology company -- including being founded in a garage in California.

The History of Olaplex

Dean Christal's family is in the hair business. His father was a beauty distributor and his mother owned her own salon out of the family home. His brother even launched two of his own haircare brands. But Dean was more interested in skateboarding and ran a skateboard brand for over 20 years.

In 2014, Christal decided to get into hair. He hired scientists to create a hair dye that would cause less damage than current commercial products. After about three years, the scientists delivered -- a "beer-like substance" that repaired damaged hair through "bond-building".

Christal got a big break shortly after when he gave a bottle to the celebrity hairstylist Tracey Cunningham, who raved about the results. Olaplex quickly became the most talked-about product in hair care.

In 2019, Christal sold Olaplex to a private-equity firm, Advent International, for an undisclosed sum. Veteran beauty executive JuE Wong was named CEO. Later that year, Olaplex sued L'Oreal, who had also been interested in acquiring the business, and won a settlement of $91 million for patent infringement.

Why are Olaplex's products so valuable for investors?

"Olaplex's patent-protected active ingredient Bis-Aminopropyl Diglycol Dimaleate works on a molecular level to dramatically improve hair from within by protecting, strengthening and repairing disulfide bonds in hair that break when damaged"

-- Company presentation

I'm no chemist, so I'm not going to try and dig too deep into the science behind Olaplex. What I do know, is that the numbers pretty much speak for themselves.

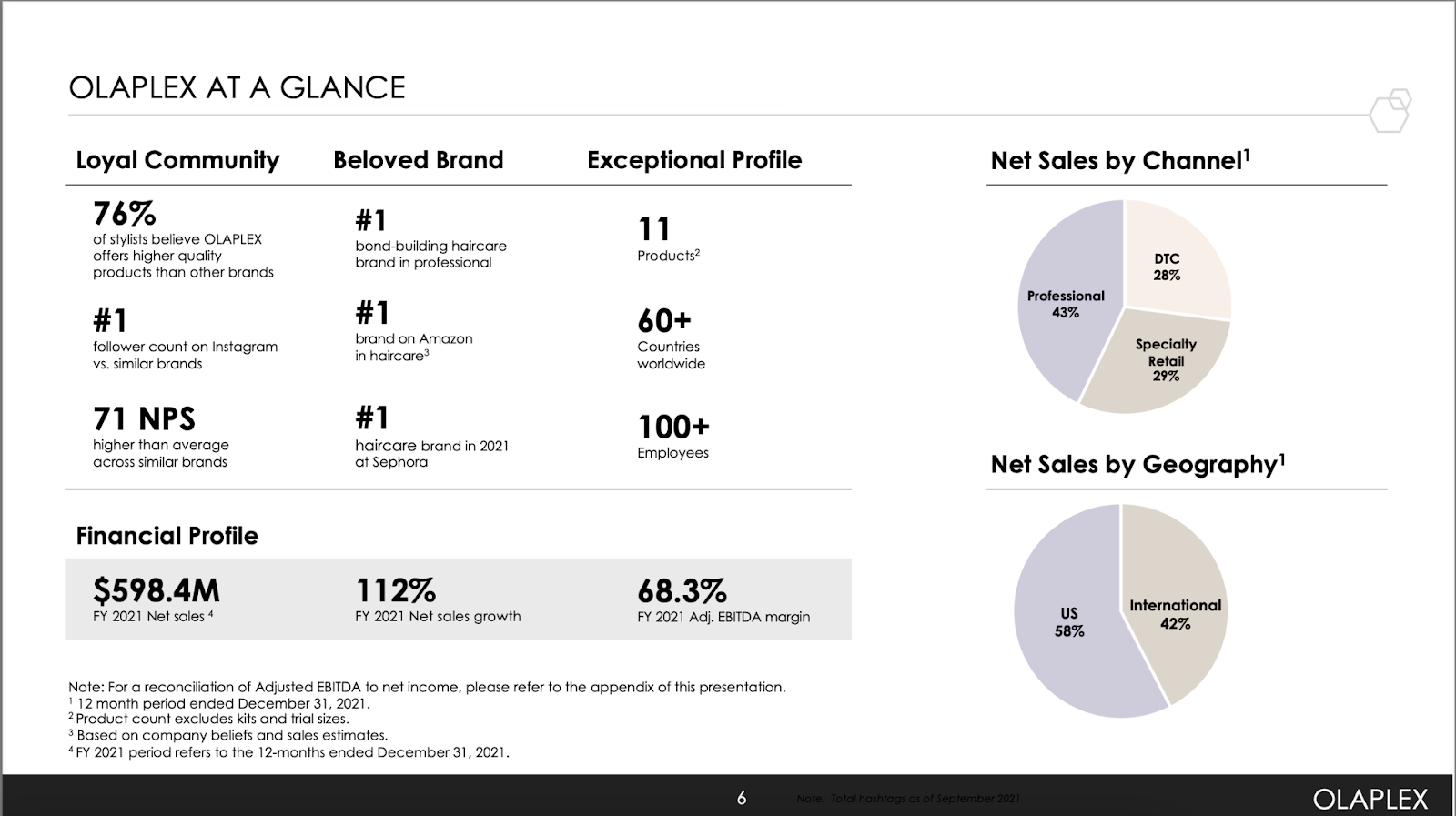

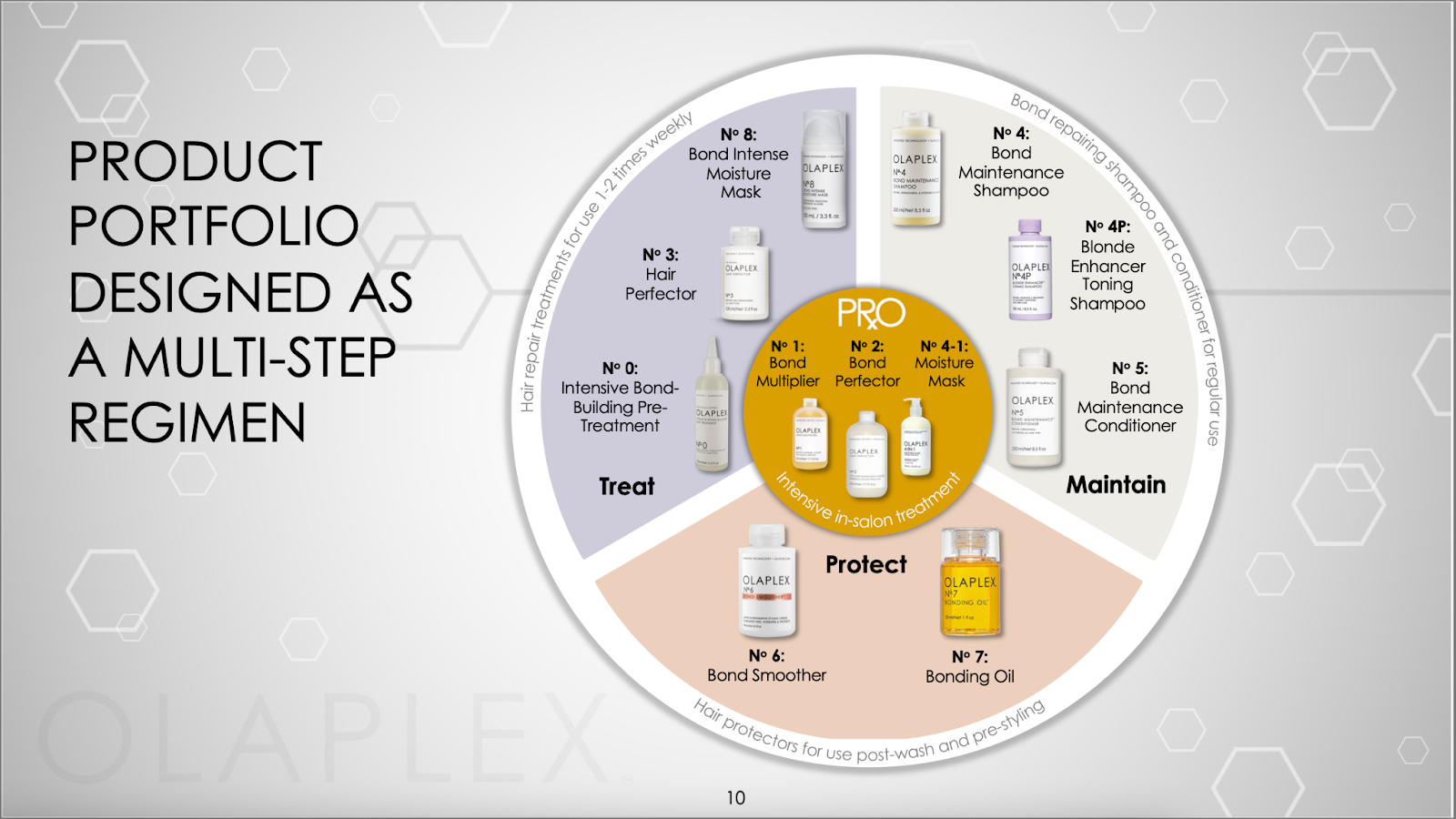

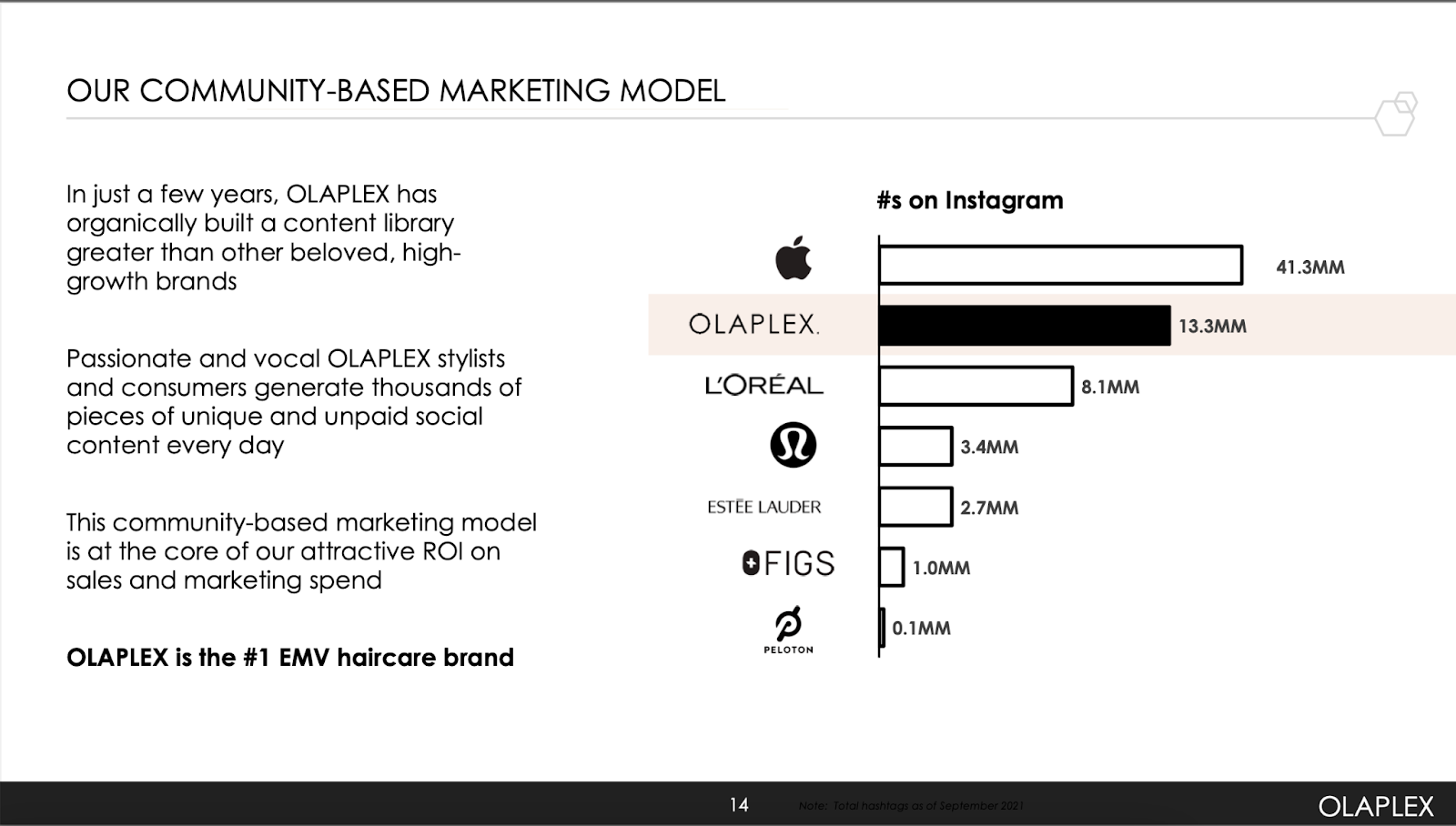

That's a lot of #1s and a lot of loyalty for a brand that's only been around for eight years. The company has a range of complementary products that it sells through an omnichannel approach. 43% of products are sold through their professional network -- hair stylists that promote the product at their salons and sell kits for home use. 29% comes from specialty retailers like Sephora, while 27% comes from direct-to-consumer.

This is a nice mix of distribution. Professional stylists can help consumers discover the most high-end bond-building products, allowing customers to purchase maintenance products through the likes of Sephora or Amazon. Direct-to-consumer grew meaningfully during the pandemic -- a sign that brand awareness is increasing. Specialty retail grew by more than 246% in 2021 as economies reopened.

From the latest quarterly report:

By channel:

Professional increased 65.8% to $259.0 million, or 43.3% of net sales

Specialty Retail grew 246.6% to $176.0 million, or 29.4% of net sales

Direct-To-Consumer rose 117.1% to $163.0 million, or 27.3% of net sales

So, we can see what might have investors excited. Those are some very impressive growth figures, and the business is still only penetrating a tiny percentage of what they believe is an $82 billion global market. The company has also set its sights on the much larger skincare market. While there's absolutely no guarantee that Olaplex will be able to strike gold twice in terms of product development, Olaplex customers are very keen to try whatever the company comes up with. According to the company, 82% of customers familiar with Olaplex would like to see them develop a skincare product and 51% would switch out their current skincare brand for an Olaplex one. That's some pretty fierce customer loyalty.

However, we've seen in recent months that investors are no longer willing to pay for growth at any cost. That's where the story gets even more exciting.

What about Olaplex's margins?

Manufacturers typically don't have great margins. After all, you have to make every product you sell. Tech companies typically have much more attractive margins, because they have zero marginal costs. Once you build a piece of software, you can send it out to as many customers as you want without any additional costs. It doesn't matter if one customer buys it, or one million customers buy it, it pretty much costs you the same -- more or less. That's why technology companies typically attract higher multiples than manufacturers or retailers or automakers.

Olaplex doesn't have zero marginal costs, but it does have very healthy margins. In the most recent quarter, the company delivered gross margins of 79%!!! That's much more like a technology company than a hair care product.

Because the company has a patent-protected portfolio of products, it is able to charge pretty steep prices. A 250ml bottle of Olaplex shampoo will cost $28 -- putting it at the high-end of the market. The company currently has over 100 patents with an average of 13 years remaining on them. Of course, at some point, those patents will run out, but for the time being, Olaplex has a strong moat that should allow it to maintain strong gross margins and grow market share.

It's working so far, Olaplex is very popular on multiple social media platforms and has successfully deployed a marketing strategy focusing on celebrity endorsements and influencers.

Further down the income statement, we see some more good news. This company is actually profitable. Last quarter the company reported Adjusted EBITDA margins of 68%. However, that doesn't tell us the whole story. EBITDA doesn't take account of interest payments, and Olaplex has quite a lot of debt on its books. Currently, the company has $738 million in long-term debt with only $186 million in cash. That's unusual for such a young company. I suspect the private equity firm loaded it up with debt in order to pay themselves well. It's not a huge worry when we consider how much cash this company is generating, but with Advent still owning 77% of the business, shareholders have no real way to prevent that kind of behavior from continuing. And that's certainly not the only risk.

What are the risks to investing in Olaplex?

A few weeks ago, the company hit some turmoil when news spread on social media that one of the ingredients in its Hair Protector was toxic and linked with infertility. It does appear that those concerns were largely overblown.

From Marie Claire:

"Before January 2022, Olaplex No.3 contained the ingredient butylphenyl methylpropional, or lilial. This is the chemical causing concern.

The European Commission published a report last year that listed the compound as Repr. 1B. This code refers to substances that are potentially toxic for reproduction. Since this finding, the ingredient is banned from all cosmetics in the EU and UK from March 1st, 2022.

Before it was prohibited, the ingredient was in almost anything that has a floral scent. From perfumes to powders, there's no doubt you've been exposed to it before.

Don't worry, research shows that the ingredient is only harmful in large amounts. Considering that it made up 0.0119% of Olaplex's old formula, you shouldn't fret if you haven't bought a new bottle this year."

So, things appear to be fine. However, news like this can cause brand damage and persist in consumers' consciousness regardless of what the science says.

There's also some concern over how protected the company may actually be. In May last year, a court overturned the previously mentioned ruling against L'Oreal, saying the company had failed to prove that the information was eligible for trade-secret protection. A new trial has been scheduled, but it demonstrates how fragile a patent-led business model can be. Olaplex operates in a highly competitive market and the likes of L'Oreal and others will undoubtedly be trying to replicate its success in this space.

I would be less concerned if the founder or creators were still involved in the business, but I am slightly worried that Olaplex could end up being a bit of a one-trick pony. I'm also not sure how loyal its customers will be long-term. Consumers can be very fickle, and the company's current success could be tied to the novelty of the product. What happens when the next thing comes along? Will consumers migrate to that the same way they did to Olaplex?

Despite the recent stock sell-off, I still think this company is very richly valued and will have to continue to grow rapidly in order to justify such steep multiples. At the moment, the stock is very much priced for perfection in what can be a volatile market. I'm going to keep Olaplex on my watchlist for now. For those who love the product and want to invest, I would suggest you do so in line with your own risk tolerance, and as part of a diversified portfolio.

Don't forget that you can listen to this blog for free in the MyWallSt App. Sign up today for a free account and get access to dozens of expertly written articles.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.