Is Pacific Biosciences A Good Investment?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

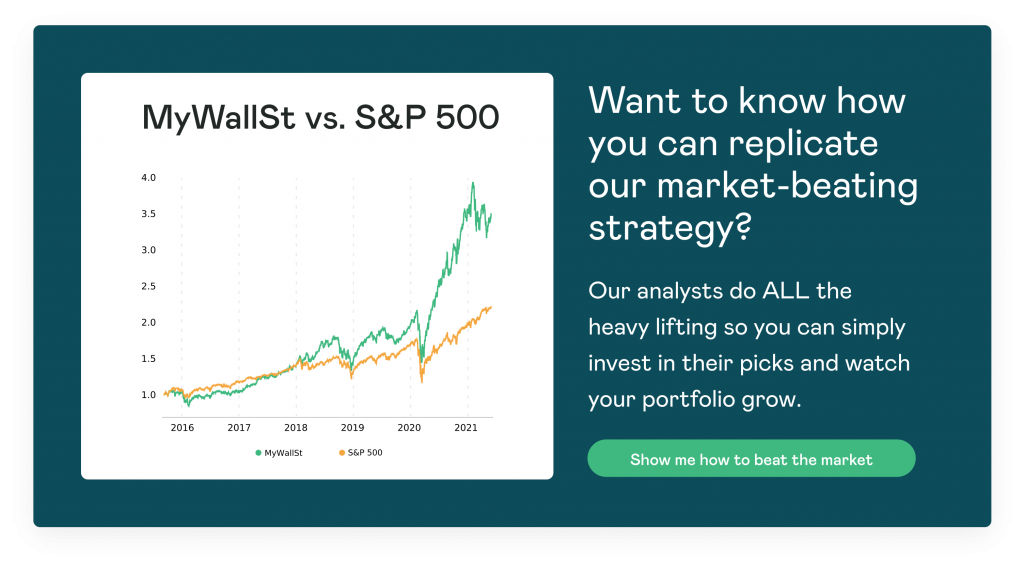

- Proven Success: 10-year track record of outperforming the market.

The human genome project was finally completed this month when scientists were able to map out the remaining 8% of our DNA sequence; these 'dark genes' were discovered to house mutations that are relevant to diseases like cystic fibrosis and Alzheimer's. With a complete picture of the codons responsible, scientists can begin the task of fixing these troubled areas and ultimately providing a cure. Pacific Biosciences (NASDAQ: PACB), or PacBio, was one of the major contributors to this success with its highly accurate HiFi Sequencing tech. This bodes well for the company as its tech will be in high demand in the future but when, and how long until it's profitable; is Pacific Biosciences a buy?

The bull case for Pacific Biosciences

In 2018, the market leader in genome sequencing, Illumina, had plans to merge with PacBio in a deal worth $1.2 billion; however, the Federal Trade Commission (FTC) put a stop to that in 2020 on anti-competitive grounds, and PacBio hit the reset button with an extra $98 million from the termination fee. Within months, the company announced a new CEO, CFO, COO, and chief commercial officer. Additionally, PacBio launched its revolutionary Sequel IIe system, which is cloud-capable, less expensive, and less data-intensive for long-read sequencing than legacy products. The system is also more accurate than any long-read sequencer before it, utilizing laser readers to ensure accuracy exceeding 99% and since its debut, the company's stock price has surged nearly 132%.

The deals also started rolling in. In October, it partnered with Invitae to develop an advanced testing protocol for epilepsy and also with Children's Mercy Kansas City to investigate challenging pediatric diseases using its HiFi sequencing tech. In February, PacBio partnered with Labcorp and the CDC to investigate variant COVID strains. Also in February, SoftBank Group announced a $900 million investment in the company (in convertible senior notes) to contribute to PacBio's future growth. The CEO last year noted the company's strong sales pipeline and announced plans to significantly increase its global salesforce, which it should have little problem doing with its $1.1 billion cash on hand.

The bear case for Pacific Biosciences

The company currently isn't profitable and recorded a net loss of $87.4 million, or $0.45 a share, in the last quarter. PacBio's business model doesn't afford the company much in the way of cash through its operations so it's had to issue shares; in fact, it has issued more than 45 million new shares since 2020, diluting shareholder value. Another point against the company involves hardware as the Sequel IIe sequencer requires additional equipment and that could be a hard sell in these economically uncertain times. And finally, PacBio is facing fierce competition from established players like Illumina and Thermo Fisher Scientific, which offer lower-priced sequencers and have significantly more capital than the smaller company.

So, is Pacific Biosciences a good investment?

Yes. Their new product will be a sequencing industry disruptor. Think of it as the main course in sequencing and the short-read, like the one sold by Illumina, the appetizer. This is the product companies will use to investigate diseases like cancer, autism, Alzheimer's, and myriad other; and considering that the company's stock price is roughly a tenth of the competition and about 45% off its all-time high, this is the time to buy.

Quickfire round:

1. Who is the CEO of Pacific Biosciences?

Christian Henry, as of August 2020

2. When did Pacific Biosciences go public?

October 27, 2010

3. How long did the human genome project last in total?

31 years

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.