Is Snowflake A Good Long-Term Investment Right Now?

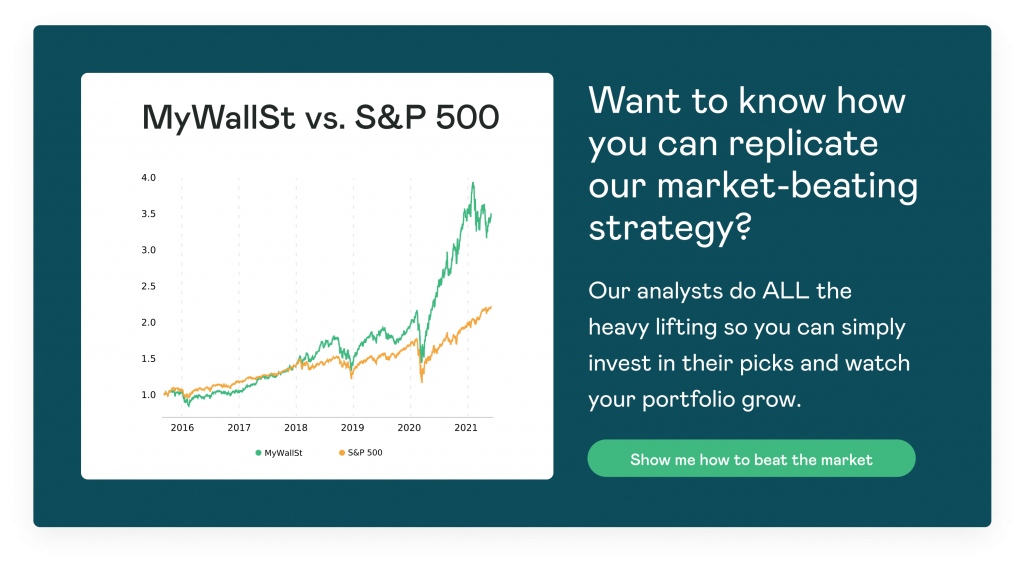

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

Snowflake (NYSE: SNOW) is a company that deals with all that data that companies need and want, but that is too large and complex for them to analyze thoroughly on their own. Snowflake provides the tools needed to gain deeper insights from company data.

Founded in 2012, Snowflake has made a name for itself in the world of cloud computing, but its financials have thrown up a few concerns. Thus, we wondered if Snowflake is a good long-term investment right now.

The bull case for Snowflake

Less than a decade old, and this company has become invaluable in the data and cloud computing market. Indeed many companies, including cloud giants such as Amazon, Google, and Microsoft, have enlisted Snowflake's software to help their own services thrive. The reason being that for certain key areas, Snowflake just has better software to handle the massive amounts of data.

Indeed, around 30% of the Fortune 500 companies use Snowflake's cloud software. Pfizer, for example, is currently using its services to analyze and predict sales and deliveries of its COVID vaccine.

This company has been so popular that when it went public in September 2020, it was the biggest IPO ever for a software company; raising $3.4 billion. Since then it has gone from strength to strength. In fact, its most recent earnings report found that its product revenue was up 103% year over year (YoY) coming in at $254.6 million, whilst its remaining performance obligations were at $1.5 billion. This means that its guidance for the fiscal year 2022 of $1 million in product revenue should be exceeded.

In total, Snowflake has 4,990 customers, with 116 of those bringing in 12-month product revenue of more than $1 million each. With a strong bull case, Snowflake is demonstrating its potential to grow as a company and present a great long-term investment.

The bear case for Snowflake

Snowflake has been affected where it lost 40% of its value between February and May but between July and September, it has regained 30% of that. The correction of this stock since its highs of $429 in December has been steep and many companies do not recover quickly from a value loss like this. But, considering the bull case above, this could present an opportunity for investors to buy Snowflake at a more reasonable valuation.

Snowflake's earnings, although there were many positives, highlighted the fact that this company was operating in the red for the last quarter. It recorded an adjusted operating loss of $21.9 million, with a GAAP per-share loss of $0.64. This could be a worrying sign as Snowflake's aim to grow bigger will incur higher operating costs.

As the work-from-home trend accelerated the need for its software, Snowflake's sales growth could slow in the coming years, especially when businesses return to the office. Snowflake's revenue could therefore also be negatively affected going into its fiscal Q3.

With rising operations costs and a decrease in revenue, Snowflake could see a few worrying problems down the line.

So, is Snowflake a good long-term investment?

Whilst Snowflake didn't have the best results last quarter, with its reported operating loss, plus the potential for a worrying report next quarter, it does still hold a lot of promise. Playing nice with big cloud data names such as Google, Amazon, and Microsoft will continue to encourage growth and customer acquisition.

Quickfire round

- Who owns Snowflake?

Snowflake has three founders; Benoit Dageville, Thierry Cruanes, and Marcin Zukowski. The CEO currently is Frank Slootman.

- Are Snowflake and Palantir competitors

Whilst Snowflake and Palantir both operate in big data, the two companies have different outlooks and target different customer pools. To find out if you should invest in Palantir today follow this link to know more.

- What does Snowflake do?

Snowflake is generally termed as a ''data warehouse-as-a-service'' company. This means that it allows companies to store and analyze data that provides insights and predictions for their own business practices.

Learn more about growth investing and what stocks make great investments by starting your free access with MyWallSt right now. Subscribe here to start generating long-term wealth.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.