Lucid Motors: 3 Competitors 'The Next Tesla' Must Contend With

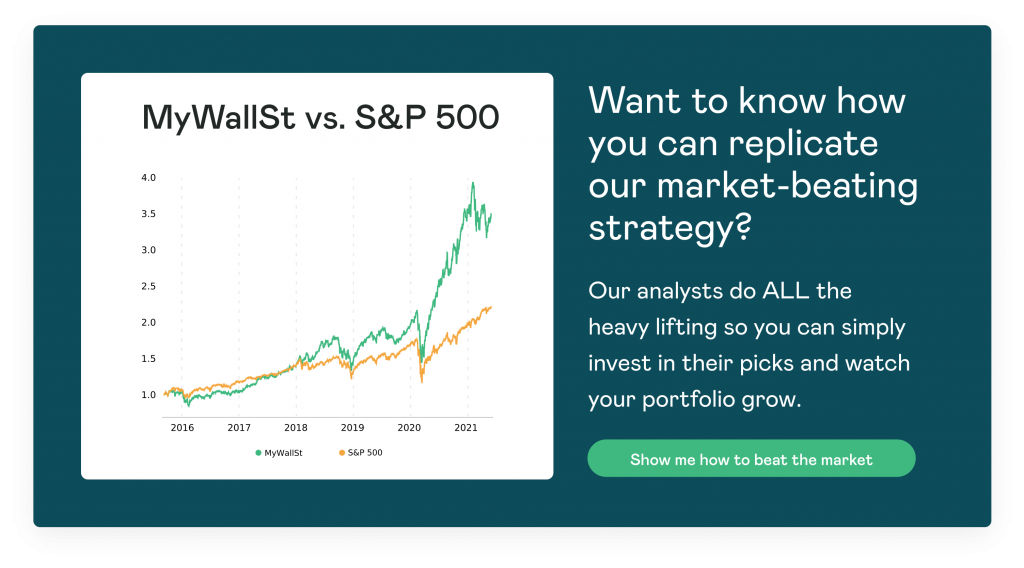

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

Lucid Motors (NYSE: CCVI) is the most recent business to be compared to Tesla (NASDAQ: TSLA) as its long-awaited debut as a public company made headlines in July. The EV startup fetched $4.5 billion on the day in new capital which will help it dominate the competitive space.

There will be many watching with heightened interest to see how this electric vehicle (EV) company compares to the likes of Tesla and the other EV makers in this rapidly growing space. But in the meantime, here are three top stocks that Lucid Motors will need to contend with.

Tesla

Jumping in with Tesla first makes sense, as this company is up there as one of the most popular with investors. Indeed, Tesla has a cult-like status, but it attracts its fair share of criticism as well, with many analysts declaring that it is grossly overvalued.

Despite its critics and the current global chip shortage, Tesla seems to just keep growing. In Q2, Tesla sailed past $1 billion in quarterly net income for the first time. Its Q2 report showed over 200,000 deliveries, a fresh record for Tesla, plus the production of more than 82,000 cars. Tesla, it seems, could be on track to exceed 850,000 deliveries in 2021 alone.

However, after a fantastic performance in 2020, the EV maker is now struggling to maintain expectations. Tesla has already faced many product mass recalls, fires, and now its Cybertruck release date has been pushed back again to 2022. Additionally, it is currently under investigation by the U.S. National Highway Traffic Safety Administration for its autopilot feature.

Although it faces increased competition, Tesla is still definitely the top dog in the lucrative EV world. Lucid Motors will have to prove itself on the public market before it can compete with the likes of this company.

NIO

NIO (NYSE: NIO) is an important company to remember when looking at competition within the EV space. NIO is a leader in the Chinese electric car market and it is growing at pace with its most recent quarter showing total deliveries of 20,000 units, representing 423% growth year-over-year (YoY). For Q2, NIO is releasing financials on Wednesday, 11 August.

Indeed, the Chinese market is heating up as the top three Chinese players all witnessed similar growth for the quarter. This is significant as it means that Tesla is beginning to lose market share in China and it opens up the possibility for other companies to enter the highly competitive and rapidly growing Chinese arena.

Unlike Tesla, NIO generates the majority of its revenue through vehicle sales -- 93%, to be exact. Unfortunately, just like Tesla, as well as General Motors, Ford, and other EV-makers, the company has shown its weakness when it was affected by the semiconductor shortage and was forced to shut down production for five days in March. This could be an issue for all EV makers in the future as the global chip shortage continues.

This Chinese automotive company is serious competition for Lucid Motors, particularly in the Asian market, where it will likely receive Chinese government support, whilst Lucid Motors, as an American company, will not.

Volkswagen

As the world pushes towards carbon-neutrality by 2030, Volkswagen (OTCMKTS: VWAPY) is the European giant driving the initiative. It has already overtaken leader Tesla in market share in Europe, with 24%, compared to the U.S.-based company's 11%. It has big plans for the future, which include building six battery cell factories by 2030 across the U.S., China, and Europe.

What sets Volkswagen apart is its experience. As one of the largest automakers, it has the power to scale its factories to switch from combustion engines to battery-powered easily to produce more output. It's ID.3 model represents significant competition for Lucid Motors as it enjoys brand recognition, loyalty, and a stellar reputation.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.