The Cautionary Tale Of MoviePass

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

Let's play a game of 'Only Connect'. What do the controversial navigation app RedZone, a nationwide network of psychics, and Chaka Khan all have in common? They're all linked to financier Ted Farnsworth.

Farnsworth is America's most unfazed businessman. He starts companies like he's collecting Starbucks rewards or airline miles. According to the Miami Herald, he has registered 50 businesses in the state of Florida in the last 30 years. Even more awe-inspiring, only four of these were still in operation by 2018 and the three that he took public saw their value drop by 99% within three years of listing.

Not to mention Farnsworth has been the target of eight different civil suits revolving around unpaid bills and has been cited 11 times for failing to pay federal income taxes on time.

Farnsworth's ventures have included a pay-per-call psychic service touted by La Toya Jackson, two energy drink companies, a vitamin manufacturer, and some run-of-the-mill multi-level marketing schemes.

All of these titans folded in spectacular fashion.

First was the Psychic Discovery Network, the epitome of '90s hotlines and their infomercials. Its 900 number racked up phone bills across the nation before the Federal Trade Commission stepped in. The Network had more than 50 consumer complaints on file, leading the FTC to label its sales tactics as "abusive" in 1998. Farnsworth stated he knew nothing of these complaints but he did sell his stake in the business.

Next up was the XStream Beverage Network, which stumbled onto the market in 2001 and drummed up investor excitement in 2002 when it attempted to acquire European energy drink, Dark Dog. Founder and CEO Farnsworth dubiously labeled Dark Dog as the Pepsi to Red Bull's Coke, somewhat embellishing its performance and recognition in the region. Sadly, the deal never materialized and Farnsworth resigned in 2007 as the company was relegated to the world of penny stocks.

Not a month later and he was back on the scene with the Purple Beverage Co. The "antioxidant-rich drink" went public via a reverse merger with a film company. For a few months it dazzled investors with its impressive array of celebrity spokespeople before collapsing in the wake of the Great Recession. This was followed by LTS Nutraceuticals, which vanished almost as fast as it had appeared due to a failure to "make required regulatory filings".

While he was down, Farnsworth was not out. In 2015, he founded Zone Technologies, the creator of RedZone Maps, a navigation app that diverts you around "danger and crime" using crowdsourced information.

Critics were quick to point out this kind of data collection promotes racial profiling, but that didn't stop Farnsworth. He hyped the company so much it attracted the attention of Helios and Matheson Analytics, an equally murky and troublesome IT and data management company based in New York. Helios and Matheson bought RedZone in 2016, making Farnsworth Chairman. He would become CEO three months later.

This would set Ted Farnsworth on a collision course with 2017's most infamous company: MoviePass.

Mission: Impossible

MoviePass was founded in 2011 by Stacy Spikes and Hamet Watt. Spikes was a music and film executive who had the idea for a movie theatre subscription as far back as 2005 but couldn't find any investors or partners.

At the time, movie theaters and production companies were focused on upselling, hence the dramatic rise in 3D cinema and big-budget pictures. Theatres believed that if they increased spectacle, they could justifiably raise ticket prices and make up for any decrease in theatergoers. When James Cameron's 'Titanic' came out in 1997, it was the highest-grossing and most expensive movie ever made.

But things changed considerably between 2005 and 2011.

The movie theatre business seems to be one of the great quandaries of the modern age. It somehow manages to be in a perpetual state of decline and yet thrives during periods of economic uncertainty. During the Great Depression -- despite mass layoffs, widespread bankruptcies, and millions of foreclosures -- Hollywood entered its Golden Age. Throughout the period, between 60 and 80 million Americans went to the movies once a week or more. Not long after, the television arrived. In 1946, British cinema attendance was a staggering 1.6 billion. By 1965, this number had fallen by more than 75%.

The cinema business ebbs and flows. When the 1981-82 recession hit, the worst since the Great Depression, American theatre attendance jumped by more than 10%, while the unemployment rate rose sharply. In 2009, during the height of the Great Recession, ticket sales were up more than 17% while attendance rose by 16% year-over-year.

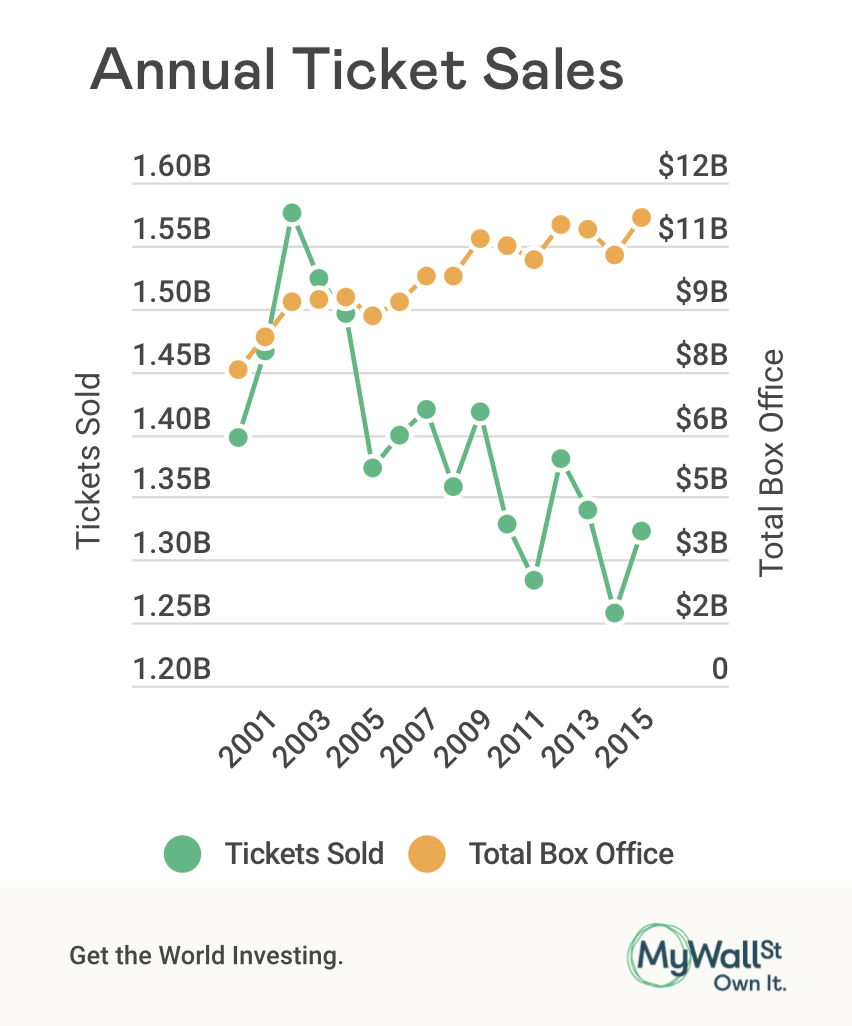

However, by 2011, things were coming to a head. The boost of Recession escapism and the novelty of 3D were quickly waning. 2011 marked the worst year for movies in more than 15 years. Ticket revenues dropped by 4.5% year-over-year while theatre attendance continued its steady decline. That same year, Netflix became the largest source of Internet streaming traffic in North America and it introduced its first original series: 'House of Cards'.

Maybe it was time to revisit the subscription service idea.

No Country for Old Men

By 2011, Spikes and Watt came together to raise $1 million in venture capital and launch a subscription trial in San Francisco. Initial demand shocked them. Despite only being offered in 21 theatres, 19,000 users attempted to sign up on the first day, crashing the company's server. But, there were still several kinks to work out.

First off, MoviePass didn't inform any of the included cinemas that the service was launching, leaving many wondering why they were suddenly being inundated with digital bookings. Most of them stopped accepting MoviePass tickets within three days.

On top of this, MoviePass hadn't quite worked out how best to collaborate with theatre chains so it was simply booking tickets on behalf of its members via MovieTickets.com. Unfortunately, MovieTickets.com is owned by AMC and the theatre giant wasn't happy its own website was being commandeered by a third-party service. It threatened legal action against MoviePass, so it was back to the drawing board.

A second test launched a few months later in collaboration with Hollywood Movie Money, a nationwide gift card company. With Money's 36,000 theaters, MoviePass launched in new markets, creating membership rates based upon average local ticket prices. Subscriptions cost between $29 and $34 a month, had a limited number of movies, and required users to print a voucher to redeem at their theatre. This was quickly deemed too cumbersome and annoying and was replaced by an app and digital vouchers. But, once again, AMC stepped in and pressured Hollywood Movie Money to break off its partnership with MoviePass or risk losing access to thousands of theaters.

Undeterred, Spikes and Watt raised more capital and gained key investors AOL and William Morris Endeavor. Together, they approached Discover Card and struck a deal to launch the MoviePass debit card. This allowed for a seamless ticketing process as MoviePass would load the cost of tickets onto the card and members would use it to pay at the box office. It also backed movie theatre chains into a corner as they were forced to accept the cards anywhere they accepted a regular Discover card. Worse still for AMC, MoviePass' popularity eventually attracted the attention of MasterCard.

By 2014, the MoviePass MasterCard had made its debut, meaning more than 91% of all cinemas in the United States could be accessed by a subscriber. This, combined with the continued decline in theater attendance, broke AMC and the chain agreed to enter into a temporary partnership with MoviePass.

Lost in Translation

In January of 2015, the one-year AMC-MoviePass pilot program was launched in Boston and Denver. At the time, MoviePass had a few thousand subscribers paying around $32 a month. This rate was raised to between $35 and $45 upon request from AMC, with additional charges for premium formats like IMAX and 3D. In exchange, subscribers could see one movie a day. MoviePass agreed to pay face value for tickets and AMC would pay to access detailed consumer data.

This partnership was a big deal for MoviePass because it was the first time it had a chance to legitimize its business model in the eyes of the wider industry. Spikes and Watt believed that the program was their opportunity to prove that a subscription service would increase cinema foot traffic and concession sales. The hope was this would eventually incentivize movie theatres to sell tickets to MoviePass at a discount, which could result in the service becoming profitable.

Over the course of the year, MoviePass and AMC prepared data for a white paper report. The results were published in early 2016 and things looked pretty mixed.

Initial figures showed the average AMC moviegoer heads to the cinema one and half times a month. After MoviePass, it increased to just over three times per month. However, this impact was not long-lasting. The rate regressed back towards the pre-MoviePass average as the service's novelty wore off. If users didn't go to the movies at least two times a month, they were paying more for a MoviePass subscription than the company would spend on tickets, meaning it could turn a healthy profit from consumers' forgetfulness.

According to Business Insider, officials within AMC were unimpressed and convinced they could create a better and more lucrative subscription service in-house. Some even believed that MoviePass had intentionally skewed data to its benefit.

For this reason, AMC terminated its agreement with MoviePass and once again the two were at odds.

If We Build It, They Will Come

Despite disappointing the largest movie theatre chain in the world, MoviePass would not give up. In June 2016, Mitch Lowe, a former executive of Netflix and RedBox became MoviePass' CEO. Stacy Spikes became co-chairman with Hamet Watt.

Lowe was quick to flaunt the service's supposed strengths: it was popular with Millennials, its subscribers spent 120% more on concessions, and it increased a film's theatrical release window by incentivizing patrons to head to the movies after opening weekend. According to Lowe, if MoviePass could acquire "3 million subscribers, it can add 5 percent to total ticket sales". This should have been great news for theatre owners and production companies, not to mention that MoviePass hoped to one day sell studios detailed consumer data to help them better select and release films.

But these silver linings were not enough to make up for the fact that MoviePass was lacking its key ingredient: subscribers -- lots and lots of subscribers.

After its AMC pilot, MoviePass' unlimited plan remained at an eye-watering $50 a month. According to the company, this was to ensure MoviePass could "bear the risk of over-usage, and get the benefit of under-usage". Clearly, this was not a deal consumers were willing to take, as MoviePass had a mere 20,000 subscribers and $10 million in revenue.

Then, Lowe struck up a friendship with Brian Schultz, the CEO of Studio Movie Grill, a small chain of Texas-based cinemas known for its in-theater dining experience. In December of 2016, Studio Movie Grill purchased a stake in MoviePass. The same week, Shultz announced Studio Movie Grill would offer its customers a one-month, unlimited MoviePass trial for $10. This instance would become a beautiful case of foreshadowing.

While Lowe admitted the temporary measure would "be expensive", he believed it was a necessary "part of their subscriber acquisition costs". Studio Movie Grill was eager for the deal in the hopes it would increase their already impressive concession revenue due to the fact they served full meals and alcoholic beverages. But with a mere 24 locations, it was unclear how much of an impact the deal would have for MoviePass.

The Big Lebowski

A year later, MoviePass was struggling. Subscriber numbers remained low, costs high, and there was no sign of any major theater chain coming back to the negotiating table.

With their dream on the line, Spikes and Lowe took investor meetings in New York, and there they met Ted Farnsworth.

Upon first impression, one former MoviePass employee called him a "bumbling, lovable, sort of optimistic guy" who "wants to be your best friend".

Another called him a "con artist"...

By that summer of 2017, Ted Farnsworth was at the helm of Helios and Matheson Analytics (HMNY), a provider of "insights into social phenomena" (whatever that means).

Clearly, Farnsworth wasn't quite sure either. According to Bloomberg, when asked what his company did he responded: "They do.... ummm... oh gosh, I don't even know how to explain it to you. Big data. Crunching data."

Insightful.

Regardless, Farnsworth's pitch to MoviePass was undeniably enticing: $25 million for 51% of the company, two seats on the five-member board, and a promise to drop the monthly unlimited subscription price, temporarily, to $9.95. It's unclear how Farnsworth got to this figure -- clearly, math wasn't involved considering the average cost of a movie ticket was more than $9. According to Business Insider: "he wanted a price that would grab headlines".

Despite the excitement of MoviePass' board, Spikes was dubious of the deal. According to him, up to that point, MoviePass had been "methodical about testing price points" and had gotten the subscription to as low as $12.99 in some regions. However, any lower than that and the service couldn't turn a profit as the low price would incentive overuse. Nonetheless, Spikes' concerns were drowned out by Farnsworth and his promise to take the company public if it reached 100,000 subscribers. MoviePass' board approved the deal in July 2017.

Within two days of the price reduction, MoviePass reached 100,000 subscribers. Within 30 days, it had 400,000. When these results were announced to the public it launched Helios' stock into the stratosphere. Over the course of a month, its share price rose from $2.50 to $20.40, a healthy eight-bagger for investors crazy enough to take a bite.

But, all the while, the company was completely unprepared to handle the pressure of its ballooning user base. Its customer service lines were flooded and its vendor ran out of plastic with which to print new MoviePass cards.

The sudden rush of customers worried Spikes and he pleaded with other executives to raise prices. But, Farnsworth and Lowe didn't want to lose momentum. By December, Spikes and Watt had been voted off the board. A few weeks later, Spikes was fired via email. The same day, MoviePass hit one million subscribers -- a milestone it hit faster than Netflix and Hulu.

Superbad

The months that followed can only be described as reckless.

Subscriber numbers continued to climb. By April 2018, there were 2 million users and MoviePass was sponsoring events at Coachella. That same month, Helios and Matheson filed its annual report to the SEC detailing a loss of $150.8 million. Helios' independent auditor began expressing doubts the company could stay in business. It was time to start cutting corners.

MoviePass' greatest adversary was its heavy users, savvy customers who were bleeding the unlimited plan for all it was worth. These titans of cinema were heading to the theatre every day, even if they didn't watch a single film. Some subscribers based in New York City reported they used their MoviePass as a way to access clean, public bathrooms in Midtown Manhattan. They would pick up a ticket for a random movie, check-in at the box office, and sneak out 5-10 minutes later. Lowe needed to find a way to slow these users down and he opted for trickery and lies.

Lowe and Farnsworth called a meeting of MoviePass' board in which they proposed to secretly change the passwords of users to block them from accessing highly-anticipated films. Executives were confused. One warned that it would "catch the FTC's attention and could reinvigorate their questioning of MoviePass, this time from a Consumer Protection standpoint." The CEO shrugged this worry off and resigned to launch the program with a "small group". He suggested they start with "2% of [their] highest volume users", representing 75,000 people.

Lowe was also eager to introduce some friction to MoviePass' consumer journey. In the summer of 2018, the company began requiring 20% of its users to upload photos of their ticket stubs for approval. If their stubs weren't approved, their account would be canceled. Lowe worked hard to ensure the "randomly selected" users were all high-power subscribers. The catch was the process didn't work on many smartphone operating systems and the service's own verification software often failed. With an almost non-existent customer service network, MoviePass had found a way to churn its most expensive users.

Both of these programs were in place for the launch of 'Avengers: Infinity War'. A couple of complaints popped up online but most disregarded the incident as a technological glitch.

Its impacts were unremarkable. By July, MoviePass was losing $40 million a month and Helios' stock had fallen 99%.

Mission: Impossible - Fallout

All the while, Farnsworth and Lowe were pretending everything was fine.

Farnsworth gave an interview to Vice in June of 2018 in which he stated "absolutely more money is going out than coming in. Which is no different from Spotify going through $4 billion [it actually lost $1.5 billion that year] or Uber, or anyone else that's a pioneer in the space". He didn't seem worried, instead, he was confident that MoviePass' data collection would pay off, proposing that the service could become vital for studio advertising.

In a bizarre, streaming service-like twist, he also revealed that executives at MoviePass planned "from day one to buy and produce [their] own movies" because they "can guarantee a box office" and curb expenses by limiting releases to subscribers. This led Farnsworth to promise a diverse array of additional services and revenue opportunities, from selling film rights to HBO and Netflix to giving subscribers free popcorn when they saw a MoviePass production.

Internally though, mayhem still raged.

Beginning in July, MoviePass implemented surge pricing, charging an extra $2 to see the latest blockbuster franchise. Lowe chalked the fee increase up to a desire to "spread out business for the company's theater partners into the weeks following the typically high traffic opening weekends". However, this response was met with skepticism from users and they complained ferociously. In reality, MoviePass was running out of money to pay for tickets.

By this time, MoviePass was losing $40 million a month and it was getting hard to hide from investors. The stock had tumbled more than 98% since it's all-time high in October 2017.

On July 26th, there was an outage. MoviePass members showed up at the theatre for late night screenings and their cards were rejected. The company was quick to blame this upon technical issues.

We've determined this issue is not with our card processor partners and will be continuing to work on a fix throughout this evening and night. If you have not headed to the theater yet, we recommend waiting for a resolution or utilizing e-ticketing which is not impacted.

-- MoviePass (@MoviePass) July 27, 2018

In reality, MoviePass' funds had run dry. According to the company: "The merchant processor that funds the MoviePass membership card stopped advancing funds for the purchase of movie tickets for our subscribers. As a result the number of tickets we could purchase was greatly reduced." This just happened to coincide with the release of 'Mission: Impossible -- Fallout', one of the biggest films of the year. In order to keep the service somewhat afloat, MoviePass blocked more than 600,000 members from booking tickets to 'Mission: Impossible' during its release weekend.

A mere five days before, Helios and Matheson had announced a 250-for-1 reverse stock split. This would boost its stock price from 8 cents to $21. Most viewed this as an attempt to prevent the company from being kicked off the Nasdaq. The day of the outage, HMNY lost more than 50% of its already deflated value.

Vertigo

On Monday, the company obtained an emergency loan. According to filings from the SEC, Helios and Matheson received $5 million in cash from Hudson Bay, which could demand repayment of more than $3 million less than a month later.

Things would never be the same again.

With the public's faith in the company firmly shaken, MoviePass practically abandoned its foundational goal. Lowe demanded that all big blockbusters be blocked on the MoviePass app. Engineers were instructed to create a tripwire that would shut down the service if MoviePass exceeded a certain amount of daily bookings. When the money ran out, subscribers would be told there were no more screenings in their area.

According to a former staffer interviewed by Business Insider: "the trip wire started at a few million dollars, but eventually wound down to a few hundred thousand". The whole process was a "guessing game".

At the same time, MoviePass had added a confusing rabbit hole to its app to trick users who had cancelled their membership into re-subscribing.

All the while, Helios stock was pushed deeper into the mud. Even with its dramatic reverse stock split, it was now trading for less than $1.

As 2018 rolled on, employees were laid off or quit the company in droves.

Despite all this, Farnsworth and Lowe continued to travel by private jet, attend high-end functions, and throw yacht parties in Miami on the company's dime. The pair were also accused of protecting their friend and MoviePass marketing consultant Bob Ellis from disciplinary action when he was repeatedly reported for sexually harassing his female co-workers.

Not with a Bang but a Whimper

In February of 2019, Helios and Matheson stock was delisted from the Nasdaq. By April, it was revealed MoviePass had a mere 225,000 subscribers, a significant drop from its 3 million subscriber peak. In a real "kick them when they are down" moment, AMC announced its competing service, Stubs A-List which cost $19.95 a month, achieved 800,000 subscribers in May.

In August, Mossab Hussein, a security researcher at Dubai-based cybersecurity firm SpiderSilk, found one of MoviePass' databases was not protected by a password. It contained 161 million records, including the personal information and credit card numbers of more than 50,000 subscribers. At the same time, MoviePass fans and retail investors were discussing the company's gimmicks on Reddit, resulting in two class-action lawsuits. These rumblings triggered a hefty investigation from FTC that was only settled in June of 2021.

On the 14th of September 2019, MoviePass bought its last ticket. The dream and the nightmare had come to a close.

Not to be outdone, Ted Farnsworth announced he was assembling a team of investors to buy Helios and Matheson and MoviePass away from its Indian parent company but these plans never materialized.

Rear Window

As an investor, it can be difficult to see serious lessons among the smoking rubble and hilarity of MoviePass but they're definitely there.

Firstly, it's a great reminder that if something seems to be good to be true, it probably is. There was no way MoviePass' model was sustainable, even with its lofty ambitions for big data, advertising, and self-made content. Companies can hype their future as much as they want but they need to survive until tomorrow to get there. In this case, it's clear the public and the media's excitement may have blinded some investors.

We can also see the trials and tribulations of the ramping up period and the difficulties company's encounter when they suddenly go viral. Mitch Lowe reflected on this in August of 2018 when he said he regretted dropping the price to $9.99 as it caused too many people to sign up. MoviePass did not have the infrastructure to support such an influx of customers.

Most importantly, MoviePass is a cautionary tale of disruption. There are plenty of antiquated industries in our midst, experiences that could be improved via technology or innovation. But solutions from one industry cannot be so hastily applied to another. When Mitch Lowe became CEO, he was heralded as the natural leader for MoviePass due to his experience in Netflix and Redbox, but the at-home movie market and the in-theatre market present very different challenges.

For one thing, you have to deal with the segmentation of the theatre industry, dominant chains like AMC, and regional price variations. This made a one-size-fits-all, direct-to-consumer subscription model illogical.

There would be no way to effectively disrupt the industry without significant theatre partnerships or a tremendous number of subscribers (and I mean way more than 3 million). MoviePass had neither and once it proved itself disappointing to AMC, it created a powerful enemy. The movie theatre business did need to be disrupted, its attendance suffered a 25-year low in 2016 but the solution was unlikely to come from outside an established player. Hence, why AMC's A-List was doing so well prior to Covid.

Finally, management teams are really important. At the onset, MoviePass appeared to be in good hands with Lowe at the wheel but once Farnsworth got involved it should have set off some alarms. In truth, it did in some spheres. Bloomberg and the Miami Herald wrote about Farnsworth's questionable past in 2017 but it appears to have flown under the nose of many.

End Credits

I would like you to imagine these next few paragraphs as the "Where are they now?" epilogue that appears in all inspirational, based-on-a-true-story movies. Each description should be imposed over an image of each character in motion and set to 'That's Life' by Frank Sinatra.

Mitch Lowe

Mitch Lowe remained at movie pass until Helios and Matheson filed for Chapter 7 bankruptcy in January 2020.

In June 2021, he and Farnsworth agreed to pay a $400,000 settlement in California for "unlawful business practices". The FTC concluded that: "MoviePass and its executives went to great lengths to deny consumers access to the service they paid for while also failing to secure their personal information."

He is now a consultant.

Ted Farnsworth

Farnsworth has always been a "fall down 7 times, get up 8"-type of guy. In 2021, he founded ZASH Global Media and Entertainment "an evolved network of synergetic companies working together to disrupt the media and entertainment industry".

Again, insightful.

ZASH is the majority stakeholder in Lomotif, an American-made competitor (complete copy-paste ripoff) of TikTok. It also owns a bitcoin mining company. Recently, ZASH merged with publicly traded Vinco Ventures (BBIG).

(Please, no one buy this stock)

Stacy Spikes

In March of 2019, Spikes started PreShow, an app that gives you free movie tickets for watching 15 to 20 minutes of ads. It would appear that idea hasn't seen much success as the company's website now says it helps users exchange their "time and attention for in-game currency for more than 20,000 of today's most popular games".

More importantly, in December of 2021, Spikes was granted ownership of MoviePass and its assets by a New York City court. It's believed his bid was for less than $250,000.

According to Spikes: "We are thrilled to have it back, and are exploring the possibility of relaunching soon."

Read More From MyWallSt:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.