The Calm in the Storm

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

Hello All,

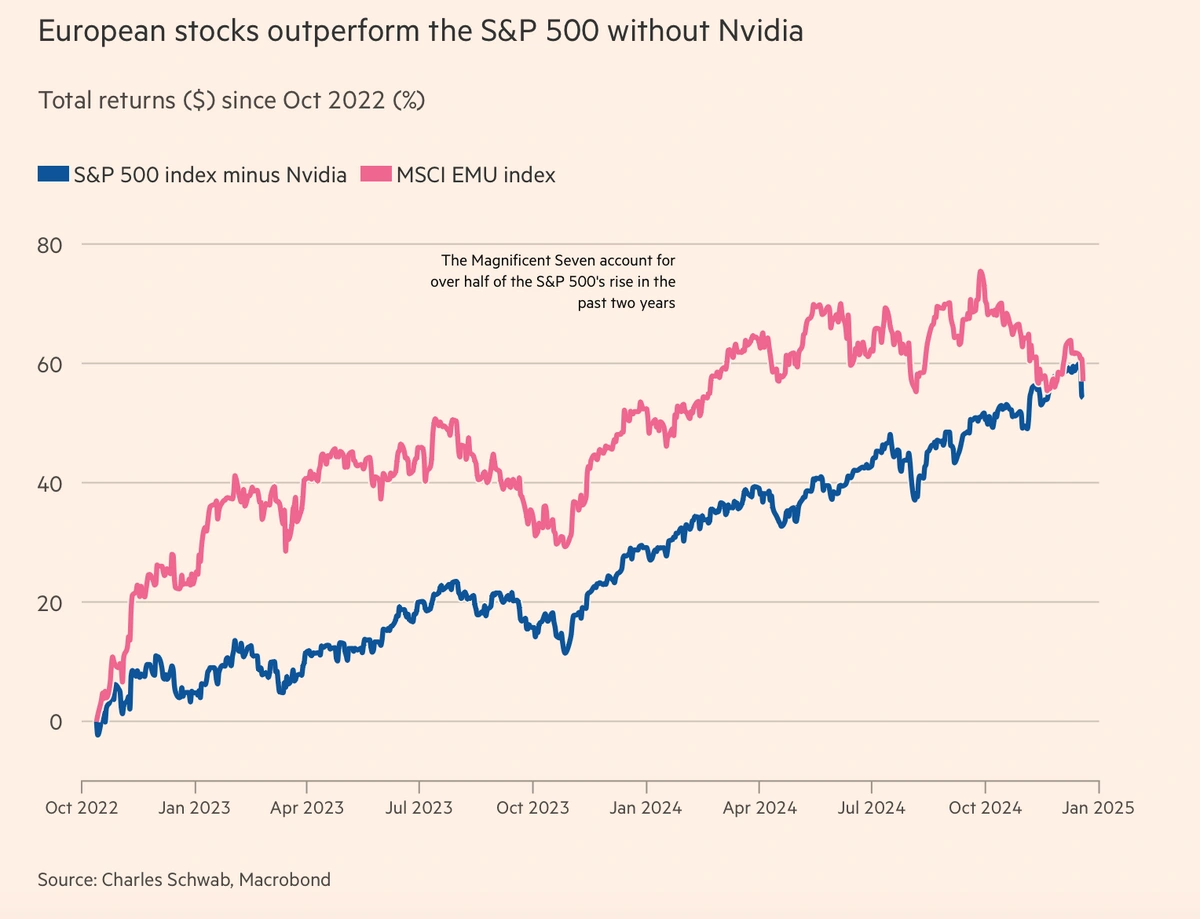

As the S&P 500 and NASDAQ fall amidst the emergence of DeepSeek, I’m reminded of the importance of diversification.

When building your portfolio, the pressure is on you to balance your holdings—especially if you’ve chosen to buy and hold individual stocks. For every high-flying, industry-defining tech stock, you need a slow-moving, non-tech behemoth, even if only to soften the sting of temporary sell-offs.

This is particularly true as tech giants now make up a disproportionate share of the market, with their movements having a profound impact on index funds. On Friday, Nvidia accounted for 6.8% of the S&P 500.

Watching the largest stock in the market drop 16% is certainly a shock, but you’d likely feel better about it if you also held something like Costco (+1.8%) or Diageo (+2.2%).

The AI sector may be correcting and dragging the broader market down with it, but plenty of other public companies are still chugging along, delivering for shareholders. Many of them have been overlooked due to the market’s obsessive focus on AI. Now is the time to make sure you have some in your saddlebags for days like this.

Let’s dive in.

Infographic of the Week

From The Financial Times

DeepSeek: The Discount LLM

DeepSeek is a Chinese AI startup owned by the hedge fund High-Flyer, and its new model, R1, has made waves by matching or even surpassing major AI competitors, including OpenAI’s upcoming model O1. However, the real shock to the market came from its claim that this was achieved with Nvidia’s cheaper H800 chips and a total cost of $5.6 million. If true, this would significantly undercut the massive capital expenditures that Big Tech firms have been pouring into AI development.

-

For context, OpenAI reportedly spent over $100 million training its latest model, making DeepSeek’s efficiency claim particularly staggering.

On Monday, the Nasdaq fell 3%, the S&P 500 was down 1.5%, and Nvidia plummeted nearly 17%, wiping out $588.8 billion in market cap—the largest single-day loss in history. Other AI-focused companies, including Meta, Google, and chipmakers like Marvell, Broadcom, and Micron, also tumbled, as did nuclear energy stocks, which have been beneficiaries of the AI boom and its power needs.

-

Nvidia’s drop was so significant that it erased more market value in one day than the entire GDP of some countries, including Sweden and Argentina.

That being said, skepticism remains. The $5.6 million figure does not include research and data costs, and some industry insiders, like Scale AI’s Alexander Wang, suggest DeepSeek may have used Nvidia’s more expensive and advanced h100 chips that should have been inaccessible due to U.S. export restrictions. Additionally, OpenAI’s Sam Altman has claimed that DeepSeek was trained using OpenAI’s API (a breach of its Terms of Service).

However, if the claims hold, it calls into question the massive capital being deployed by AI leaders and could shift the AI race from hardware dominance to a focus on application and efficiency.

More broadly, DeepSeek’s breakthroughs could democratize AI, lowering the barrier for new entrants and accelerating innovation in unexpected ways. If this marks the start of AI’s commoditization, the real winners will be companies that build the most useful applications, rather than those that simply amass the most computing power.

Nvidia and other big tech companies certainly are not out of the race but their moat of R&D spending looks a whole lot weaker.

Slow-Moving like a Tractor

Since I’ve been advocating for portfolio diversification, it’s only right that I pitch you a boring, non-tech business.

Tractor Supply, the largest rural lifestyle retailer in the U.S., operates over 2,270 stores catering to farmers, ranchers, gardeners, and pet owners. For my Irish readers, think of it as the Woodies of America—if Woodies was focused on rural communities instead of urban and suburban areas.

Key Growth Drivers:

-

Pet Industry Expansion: Tractor Supply has capitalized on the booming pet market, acquiring online pet pharmacy Allivet to tap into a $15 billion opportunity. Its Neighbor's Club loyalty program boasts over 37 million members.

-

Pandemic Tailwinds: Rural migration during COVID-19 boosted demand, doubling earnings since 2019.

-

Strategic Leadership: CEO Hal Lawton has sharpened Tractor Supply’s focus, driving long-term growth.

Challenges:

-

Cyclical Sales: Revenue is impacted by seasonal trends and economic conditions, evident in its modest 1.6% Q3 2024 sales growth.

-

Climate Risks: Weather fluctuations affect peak-season performance.

Competitive Position & Investment Considerations:

Unlike big-box retailers like Home Depot or Lowe’s, Tractor Supply dominates the rural niche, and its move into pet services strengthens its moat. With a stable dividend yield (1.5%) and a resilient customer base, it remains a solid long-term play—especially when market volatility makes steady, slow-growth companies more attractive.

Happy Investing,

Emmet

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.