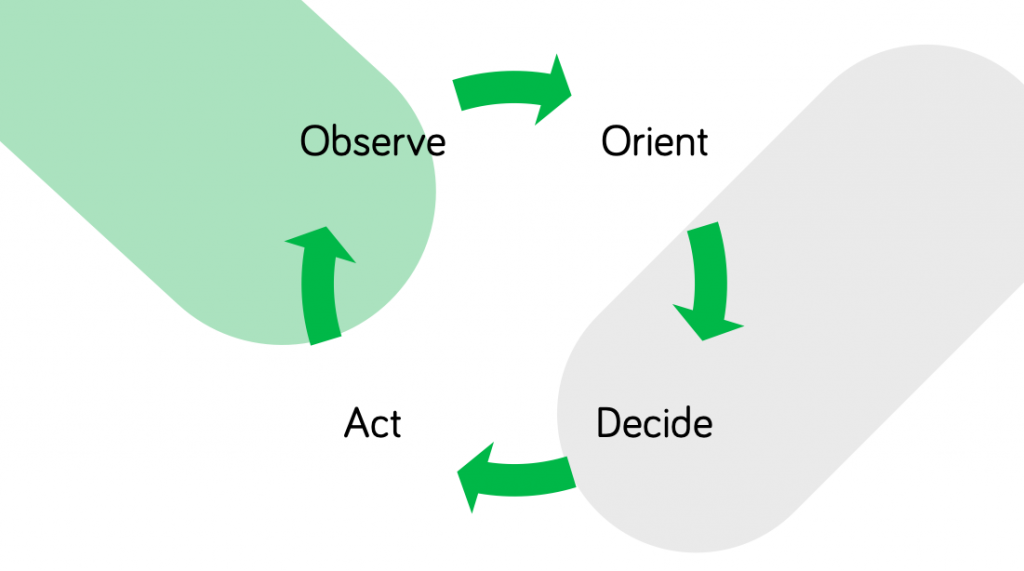

The OODA loop of financial planning

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

This guest blog comes from our friends at Moneycube.ie, a leading provider of online investment and pension advice. In it, co-founder Ralph Benson explains that a financial plan doesn't need to be complicated, and demonstrates a simple approach with its origins in US military strategy.

Financial planning has a bit of a bad name: boring AND expensive. But done right, a financial plan is a roadmap to financial freedom, confidence and security.

It's true that you can spend a lot of money with some advisors, developing a plan covering all aspects of your financial life over many years. And if your finances are complicated, that might be what you need.

Keep it simple

But for the other 99% of the population, what's needed is a simple and practical plan which covers your main bases.

In fact, rather than trying to create the ultimate financial plan (spoiler: it doesn't exist), the most important thing is that you have some kind of plan - however imperfect.

And remember no-one reaches all their financial goals overnight. It's an ongoing exercise.

That's why we like the OODA loop.

What's the OODA loop?

The OODA approach has its origins in US air force, as a way to get ahead of the enemy by being clear in your own mind what your current position is, what your options are, then taking a decision, putting it into action, and going through that loop on a regular basis.

We find it good because it's simple, and it's not a one-off process - both of which are important when you're dealing with money.

So how can this be applied to a financial plan?

It means:

Properly understanding your current situation (Observe);

Forming a view on what your options for change are (Orient);

Agreeing actions you can take today (Decide);

Putting them into practice (Act); and then

Establishing an ongoing process to review and build your portfolio over time (the loop).

For example, you might observe that although you're well paid, you've not built up much in the way of investments outside your bank account and some stock options through work.

The next step would be to orient yourself by looking at what kind of investments are out there, and what fit your requirements.

You might decide that you want to be invested by the end of the month, and take action to make it happen.

Then time passes and the loop re-starts. It's time to review how your investment has performed, if there are new options available and so forth.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.