The Storied History of Elon Musk's Twitter Account

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

This article can be found in the MyWallSt App, alongside an audio companion. Sign up today for a free account and get access to dozens of expertly written articles and analyst opinion pieces every month.

Love him or hate him, nobody is introduced with the words "love him or hate him" more than Elon Musk. The enigmatic CEO of Tesla (NASDAQ: TSLA) and SpaceX, and the reigning Time's Person of The Year, is unquestionably the most influential business leader out there. From smoking weed on podcasts to dad dancing on stage, he is never shy of making headlines, most of the time to the ire of his shareholders.

Nowhere does he celebrate this attention and influence more than with his Twitter (NYSE: TWTR) account. He boasts almost 80 million ardent followers and a reach that expands well beyond that figure. He is a fan of using the platform to share his many, many thoughts on the world with us which can have varying consequences. Inspired by Monday's tweet in which he stated he won't sell his Bitcoin, Ethereum, and Dogecoin holdings and the inevitable price bump that accompanied it, I'm going to take a look back at Musk's most infamous social media activities and the wider effect he can have on financial markets.

On an unrelated note, just for kicks, here's Investopedia's definition of securities fraud:

Securities fraud, also referred to as stock or investment fraud, is a type of serious white-collar crime that can be committed in a variety of forms but primarily involves misrepresenting information investors use to make decisions.

Is this Elon Musk's most infamous tweet?

Let's kick it off with a doozy. Musk's piece de resistance when it comes to market manipulation-led trolling occurred in 2018 when he claimed he would take Tesla private once it reached $420 a share -- this obsession with childish numbers is a bizarre undertone to much of his social media presence. As you would expect, such blockbuster news came as a bit of a shock to many investors, who were given the choice of selling at $420 or holding and going private.

Surprisingly, for someone who says pretty much whatever he wants sans consequence, this particular tweet had some repercussions, with the SEC eventually charging him with securities fraud. Here are the sanctions from those 61 characters:

- Musk was ousted as Tesla Chairman and banned from the position for three years

- Tesla was fined $20 million

- Musk himself was also fined $20 million

- He agreed to have his tweets pre-approved by Tesla's in-house counsel

- Tesla was forced to add two new independent directors to its board.

The SEC had this to say:

"Musk knew that he had never discussed a going-private transaction at $420 per share with any potential funding source, had done nothing to investigate whether it would be possible for all current investors to remain with Tesla as a private company via a 'special purpose fund,' and had not confirmed support of Tesla's investors for a potential going- private transaction".

Market reaction: Tesla (TSLA) down 24% in 4 weeks.

Did Elon Musk actually sell shares because of a Twitter poll?

I know what you're thinking. That's a pretty firm slap on the wrist, and with a new review process in place, the man must have learned his lesson, right?

Wrong.

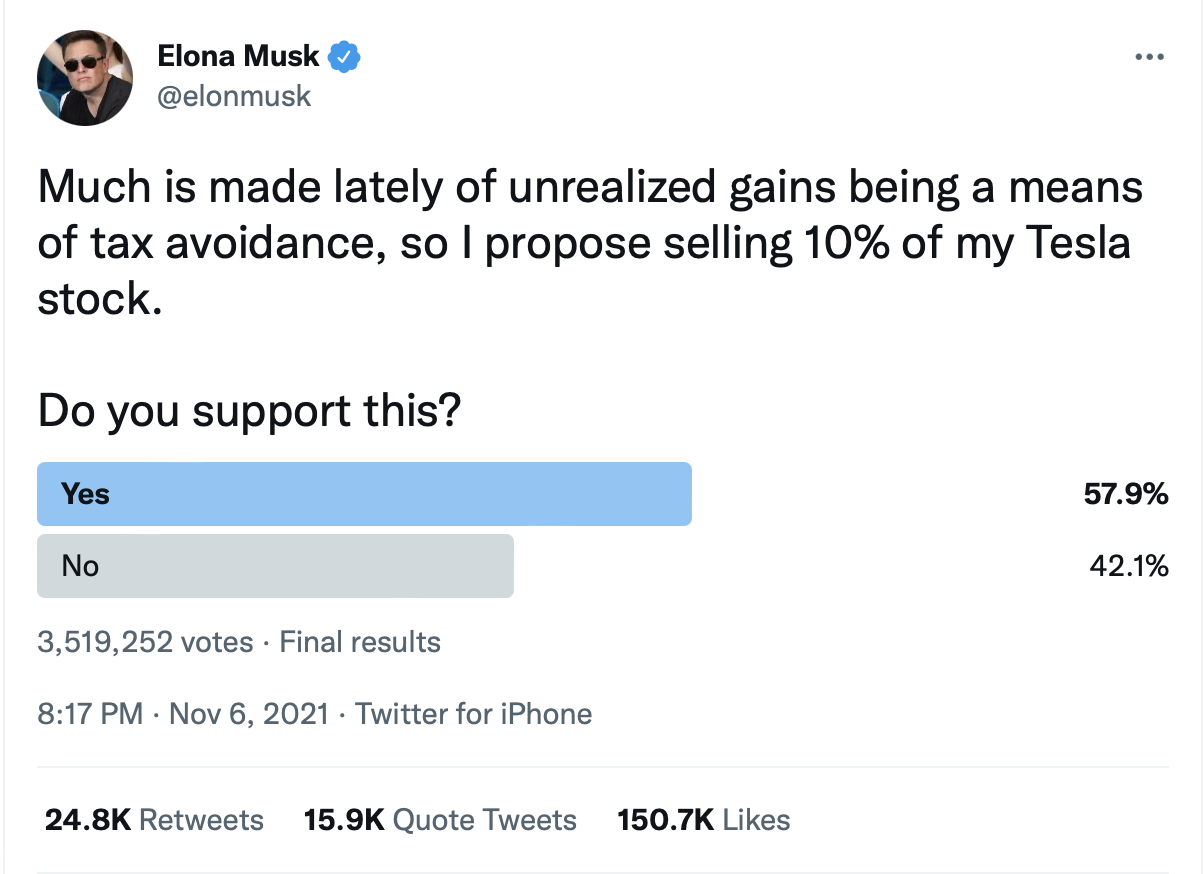

While there are many tweets in between, Musk's next truly great transgression was a poll in which he asked his followers whether he should sell 10% of his Tesla holdings. They said yes. And he did. Of the 3.5 million votes on the poll, 58% voted to sell, and Musk would go on to relinquish more than $16 billion of Tesla stock over the next two months.

What wasn't included on social media was the looming income tax bill of around $15 billion facing the Tesla CEO and the eventuality that he would have had to sell a significant amount of shares in order to pay the tax expense attached to his expiring stock options.

Maybe Twitter's character limit was to blame for this omission? Or maybe the devoted CEO who never sells any of his own shares wanted to maintain this visage. Instead of selling vast amounts of Tesla stock to pay an income tax bill, he's now selling vast amounts of Tesla stock because his followers said so and he's a quirky guy who just does things like that. Who could say? Well, the fact that some of the consequent sales were pre-arranged weeks before the poll may skew public opinion, but really, who could say?

The cherry on top of this subterfuge sundae is still forming, however, with the SEC opening an investigation into both Elon and his brother Kimbal for insider trading. Kimbal sits on Tesla's board of directors and sold $108 million worth of shares the day before the poll was published. The investigation will hinge on whether Elon told his brother of the poll before tweeting it out to the world. At best, a terrible look for the company, at worst, potential jail time.

Market reaction: Tesla (TSLA) down 27% in 6 weeks.

How Elon Musk has influenced the crypto world

If there was ever an industry more capricious than the stock market, it has to be crypto. The risky assets have certainly caught Musk's attention, where his presence may be felt even stronger. So much so that Coindesk named him as one of the most influential figures in the industry. A lofty title for an occasional commentator. The constant commentary on Bitcoin, and Dogecoin, in particular, led to the creation and destruction of billions in market value.

His crypto manipulation can't be nailed down to one particular tweet -- does that mean it's decentralized? -- but rather an incessant toing and froing that is sure to have made industry experts pull their hair out in frustration. Here's a quick taste from the start of last year when speculation in the market was most rife:

- He kicked off last January by changing his Twitter bio to #bitcoin sending the cryptocurrency up 13%.

- In February, he tweeted "Doge" amongst a litany of other pro-Dogecoin tweets and memes that sent the price of Dogecoin up 50% in the space of a day.

- In March of 2021, he tweeted: "You can now buy a Tesla with Bitcoin". Now he's making some real moves with Tesla-backed actions, rather than posting memes. It didn't last long, however. Just two months later, he would announce that Tesla would no longer be accepting Bitcoin payments due to environmental concerns around mining. The price of Bitcoin almost halved in the space of a week.

- In April, he tweeted: "The Dogefather SNL May 8". DOGE's parabolic rise -- which Musk can claim a lot of responsibility for -- peaked before the show. It grew more than 2,000% from February to May. He would go on to call the cryptocurrency "a hustle" on-air, sending it crashing. It has fallen 70% since.

While Musk hasn't given up on his crypto-puppeteering -- this past January he announced you can buy Tesla merchandise with Dogecoin -- it has seemed to calm slightly along with the market. One thing is for certain though, if there is an opportunity to flex his influence somewhere, he's shown time and time again he will take it.

The best of the rest of Elon Musk's Twitter account

Musk doesn't need to say a lot to sway market sentiment either, even when he's not trying to. Here's a list of some of his most impactful one-liners:

- "Gamestonk!!" -- This tweet was accompanied by a link to the WallStreetBets subreddit. GameStop popped 157% in after-hours trading amidst a wider short-squeeze. Tough to give Elon too much credit for this but of course he couldn't sit out the fun.

- "Use Signal" -- even when he's not trying to influence the market, he still influences the market. Musk endorsed the privately owned, encrypted messaging app Signal. After this tweet, however, the over-the-counter healthcare stock Signal Advance -- ticker symbol SIGL -- jumped almost 6,000%!

- "I kinda love Etsy" -- after buying a hand-knitted hat for his dog, Elon tweeted his appreciation for the craft marketplace. Etsy stock popped 8% in mid-day trading before closing up 2%.

- "Tesla stock price is too high imo" -- simple and effective trolling here, Tesla shares fell 10% on the day before quickly recovering.

- "Baby Shark crushes all! More views than humans." -- closing out with possibly the most bizarre, Elon's thoughts on the migraine-inducing Baby Shark sent Samsung Publishing -- which is a major shareholder in the song's producer -- 10% higher.

Elon Musk's Twitter account In his own words

Bizarre, benign, bored, bravado, unintentional or maybe intentional, sinister, fraudulent, pontificating, securities fraud, insider trading, trolling, meme-ing, misleading.

Pick any three and you probably wouldn't be too far away from describing the chaos that is Elon Musk's Twitter account. It seems he gets a kick out of the influence he wields. If there is a fun anti-establishment trend doing the rounds, he won't be far behind. The richest man in the world, sitting in his ivory modular home, sewing discord and mayhem at a whim. A Gen-Z Bond villain.

The real answer is, should we be concerned about it? Is his behavior in the Twittersphere a tangible risk for Tesla? I guess it depends on how seriously you take it. Whether you see 'funding secured' or "stock price is too high" as a bored genius letting off some steam, or a series of genuinely destructive behavior that can eventually derail one of the most exciting companies on the market.

Nonsense or nefariousness. Who can say?

I'll let the man himself close out this piece in his own words:

Don't forget that you can listen to this blog for free in the MyWallSt App. Sign up today for a free account and get access to dozens of expertly written articles.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.