What does Apple's $90 billion stock buyback mean for investors?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

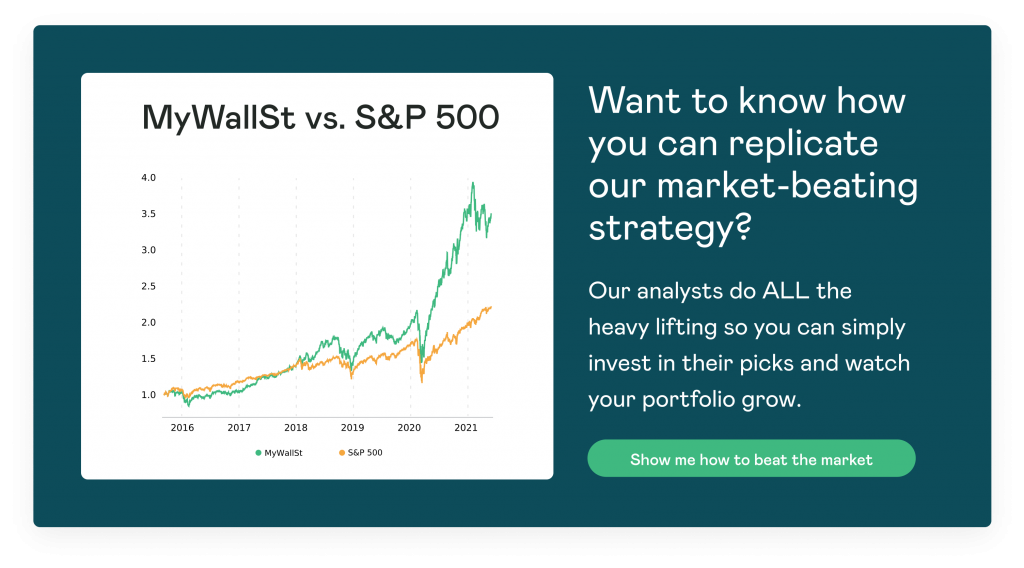

- Proven Success: 10-year track record of outperforming the market.

Apple (NASDAQ: AAPL) was its usual expectations-beating self in Q1 back in April as the iPhone maker smashed analyst expectations.

However, some investors are wondering about one $90 billion question from its report...

What is a stock buyback?

As the name suggests, this is when a company buys back its shares from the marketplace, thus reducing the number of outstanding shares on the market. The company might buy back shares because it believes the market has discounted its shares too steeply, to invest in itself, or to improve its financial ratios.

And Apple is no stranger to this, having bought back $50 billion worth of shares in 2020 and $75 billion worth in 2019. But to discern the why behind Apple's $215 billion spending spree, we'll need to go back to Apple's Q4 conference call in February 2018.

Luca Maestri, the company's CFO, outlined that due to changes in the tax laws:

"Tax reform will allow us to pursue a more optimal capital structure for our company... and given the increased financial and operational flexibility from the access to our foreign cash, we are targeting to become approximately net cash neutral over time."

So, net cash neutrality is what Apple is after. While I won't get into the intricacies of cash neutrality for fear of embarrassing myself, (you can read all about it here) I will say that this is nothing to be concerned about for investors. In fact, Apple increased its dividend payments to $0.22 back in May.

Retail investors in Apple can take comfort in knowing that the company will continue to increase shareholder value, and as its earnings call evidenced, it's got no problem making money.

You can learn more about stock buybacks on our blog here.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.