What Is A Better Investment: FuboTV Or CuriosityStream?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

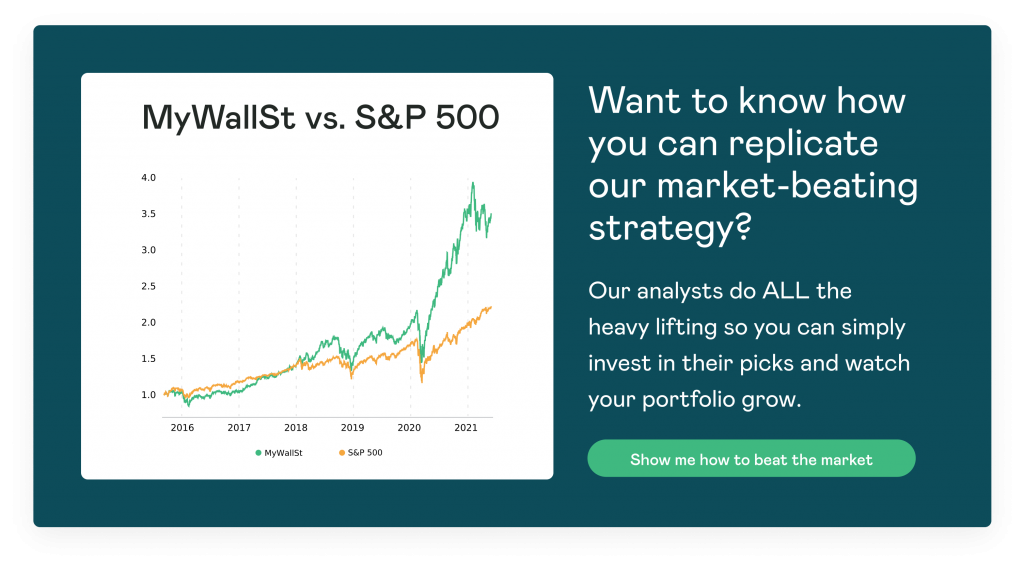

- Proven Success: 10-year track record of outperforming the market.

The global video streaming market saw an acceleration in 2020 due to COVID-19, with 78% of U.S. households now subscribing to at least one streaming service. This cord-cutting trend looks to continue and with a secular tailwind, we ask which of these niche streaming services is a better buy?

Bull and bear case for FuboTV

FuboTV (NYSE: FUBO) is a streaming service that focuses primarily on live sports streaming. It was founded with a mission "to provide the world's most thrilling sports-first live TV experience" through premium content, interactivity, and integrated wagering.

FuboTV has had a strong 2021 and in Q2 reported revenue growth of 196% year-over-year to $130.9 million. This revenue growth was driven by average revenue per subscriber increasing by 30% YoY to $71.43. Its advertising revenue also surged by 281% to $16.5 million and makes up an ever-increasing portion of revenue. On top of this, the company also raised fiscal 2021 guidance.

The company continues to attract paid subscribers to its platform and reported triple-digit growth of 138% to 682,000 in Q2. Engagement on the platform was a record 245 million hours in Q2, while the number of hours streamed per user stood at 134 hours per month. Management also believes that in the multichannel video programming distributor space, it currently commands about a 6% market share.

An exciting area for growth is the sports wagering market with Balto Sports and sportsbook platform Vigtory. The company is building out the Fubo Sportsbook app which, in an industry-first, will update with relevant bets depending on what the user is watching. Management aims to have market access to roughly 50% of its total subscriber base by 2023, and the segment to have 50% gross margins. It has also launched free gaming, which it hopes will attract users to its sportsbook offering.

There are several significant risks, such as the ability for the company to gain rights to different sports, leagues and games, and it is critical if it is to continue to grow.

Its Sportsbook business will also be key to its overall success according to management, and there is a significant execution risk due to the early stage of this segment. On top of this, the company is operating at a loss of $94.9 million, which expanded year-on-year (YoY) along with competition in its different segments from Disney's Hulu, Draftkings and others.

Bull and bear case for CuriosityStream

CuriosityStream (NASDAQ: CURI) is a streaming service with a mission to "satisfy humanity's enduring curiosity" through its premium factual content. It went public in 2020 through a special purpose acquisition company (SPAC).

CuriosityStream is the only public factual streaming service company with over 3,100 documentaries in its library, with over one-third originally produced. The company estimates that it can produce this factual content for roughly one-tenth of the cost of other content. This is crucial as it allows it to undercut the competition and to compete with larger players.

In Q2 2021, CuriosityStream reported revenue of $15.3 million, increasing 27% YoY with strong gross margins of 63% higher than other streaming players like Roku. It is also guiding for revenue growth of 80% in fiscal 2021 and management stated it has "90% of our full-year revenue goals of $71 million committed". It estimates that its market opportunity will be $390 billion by 2025, leaving a large runway for growth.

The company also continued to attract subscribers, with the total subscribers standing at approximately 20 million, representing a growth of 40% YoY. CuriosityStream has also retained more of its customers from Q2 2020, than any other streaming service, including Netflix.

CuriosityStream has a highly experienced management team. John Hendricks is the founder and chairman and has a successful track record in the industry, having previously built a digital empire at Discovery Communications. Current CEO Clint Stinchcomb also worked at Discovery and has over 25 years of experience in traditional and digital media. Hendricks also has a significant stake in the business, which aligns his values with shareholders.

The company is operating at a loss which expanded to $8.3 million in the quarter. There is also growing competition from other streaming players such as Disney and Discovery, which have larger cash reserves to enter this niche. In addition due to its size the stock is likely to be volatile.

So, which stock is a better buy right now?

CuriosityStream appears to be a better buy right now from a risk versus reward perspective. It has a visionary founder, many revenue streams, is executing and has the potential to be a multibagger in the coming years.

If you want a slice of the streaming pie, check out MyWallSt's shortlist of market-beating stocks. Get on the path to financial freedom by starting your free access today.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.