What Is A Better Investment Right Now: Hims & Hers Health or Teladoc Health?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

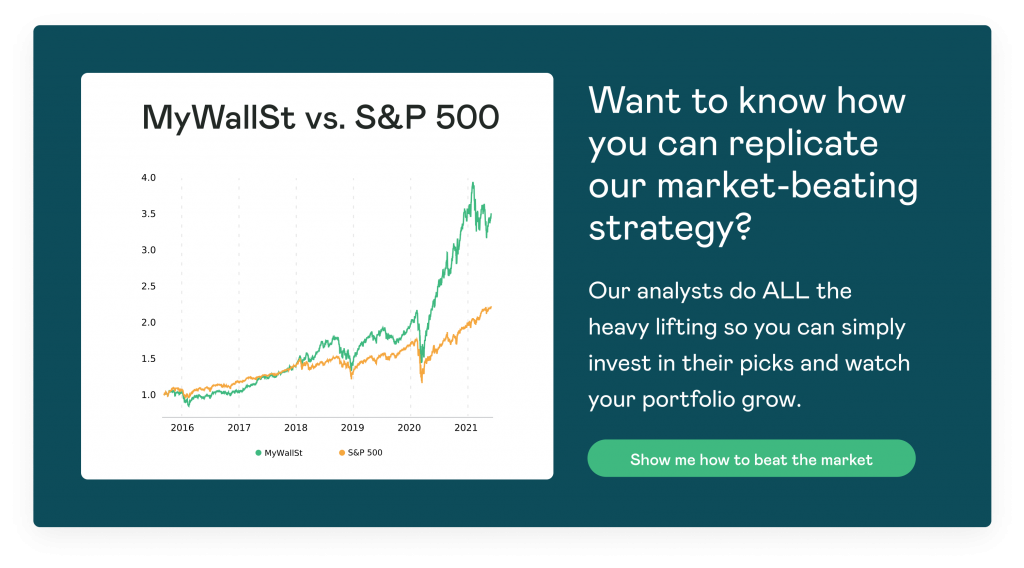

- Proven Success: 10-year track record of outperforming the market.

The onset of the COVID-19 pandemic in early 2020 exposed many of the failings of the U.S. healthcare system, with the pandemic fueling a shift towards digital care. This acceleration has created tailwinds for companies operating in the healthcare technology industry. This digital trend looks set to persist, and a study by Ernst & Young found that there will be continued adoption by both consumers and physicians of digital health technologies post COVID-19.

We examine an established player in the telehealth space Teladoc Health Inc. (NYSE: TDOC), and a newly-listed competitor Hims & Hers Health Inc. (NYSE: HIMS) and ask which growth stock is a better buy?

Hims & Hers Health: Bull vs Bear arguments:

Hims & Hers Health provides telehealth services and sells over the counter, prescription drugs, and personal care products online and went public through a $1.6 billion SPAC deal in 2021. The company was founded in 2017 by current CEO Andrew Dudum, and both the company and Dudum have many positive reviews on Glassdoor, albeit with a small sample size.

Hims & Hers mission is to eliminate stigmas and make it easier for people to access care and treatment for conditions affecting their daily lives. Approximately 80% of its customers are seeking treatment for their condition for the first time. It strategically targets Millennials, which it says are the future of healthcare and plans to grow with them as their healthcare needs evolve. Hims also has a high net promoter score (NPS) of 65, which indicates that its customers like the company.

In Q1 2021, Hims reported revenue growth of 75% year-over-year (YoY) to $42.3 million and expanding gross margins of 77%. The majority of its revenue is subscription-based at roughly 91%, with the number of subscribers growing to 391,000, an 80% increase YoY is a positive sign for investors. Currently, it estimates its total-addressable market to be over $500 billion in prescription drugs and primary care leaving a significant runway for growth. Further expansion into chronic conditions in several categories would create a further $127 billion market opportunity, but investors should take these estimates with a pinch of salt.

However, Hims is operating at a loss which expanded significantly YoY in Q1 from $6 million to $51 million. This may cause concern despite management stating this is due to going public and stock-based compensation. It also faces stiff competition in the telehealth space, particularly from Teladoc and Amwell, and in the direct to consumer space from many private companies.

Teladoc Health: Bull vs Bear arguments:

Teladoc Health is a telehealth and virtual healthcare company and is the largest player in the space with 52 million members. It was founded in 2002 and went public in 2015. The company was one of the COVID-19 tech darlings that stock price rose sharply but has since declined with the re-opening looming.

COVID-19 has permanently changed the healthcare landscape with increased adoption, with CEO Jason Gorevic stating that telehealth is an acceleration of an existing trend "by four or five years". Teladoc estimates that its market opportunity is roughly $250+ billion and expects to grow at a compound annual growth rate of 38% over the next few years.

In Q1 2021, Teladoc reported robust revenue growth of 151% YoY to $454 million with an expanding gross margin of 67.8% and raised guidance. It provided 3.2 million visits, an increase of 56% YoY and Teladoc is also loved by its customers with a NPS of 95. Management also expects that a number of deals that they are closing will have a more significant impact in 2022 than the current year.

The Livongo merger means that Teladoc is no longer reliant on telehealth with an increasing number of visits from non-infectious diseases. The Livongo merger has meant that Teladoc now offers a full suite of products and the opportunity to cross-sell due to minimal overlap.

Teladoc reported a net loss of $199.6 million in Q1, which widened due to stock-based compensation. Another cause for concern is that management did not forecast strong membership growth, forecasting for 1-3%. Competition also remains a concern with even larger players like Amazon intent on entering the space.

So, which stock is a better buy right now?

Both companies offer compelling growth opportunities, and it is unlikely to be a "winner takes all" scenario. However, Hims & Hers faces an uphill battle due to larger competition. Teladoc appears to be a better buy today as it is a market leader with a full suite of products, and the stock is still down significantly from its all-time highs.

If you want to stay ahead of the curve and invest in growing industries, MyWallSt's got you covered with a shortlist of market-beating stocks, so you too can accumulate long-term wealth. Simply click here for free access today.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.