What Is A Better Investment Right Now: Pacific Biosciences or Illumina?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

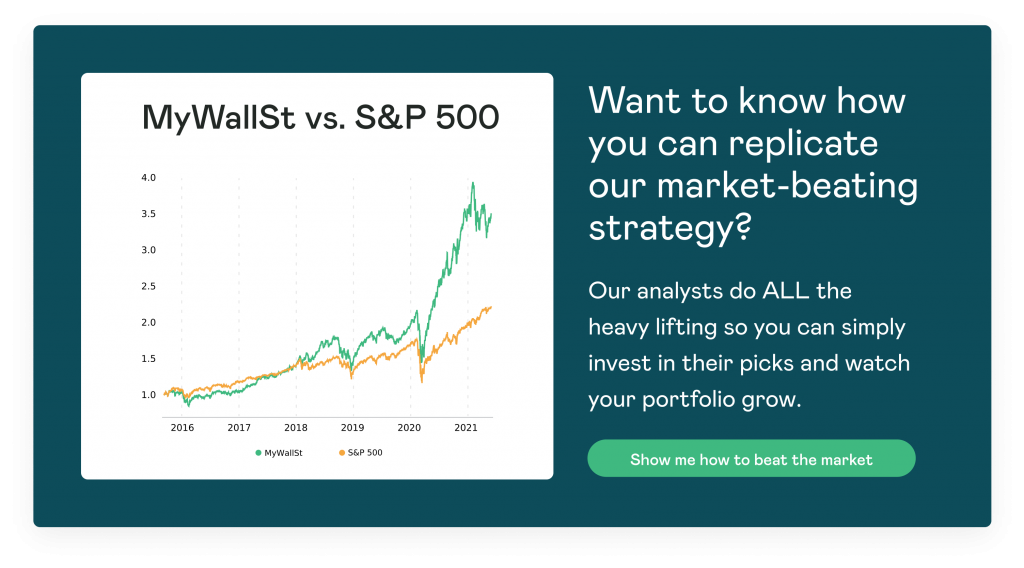

- Proven Success: 10-year track record of outperforming the market.

Companies in the genome sequencing market have historically been primarily focused on short-read genome sequencing. Illumina (NASDAQ: ILMN) focuses on short-read and long-read sequencing and has dominated the industry for years. It is 21 years since the first draft of the human genome was mapped out. The remaining 8% of the human genome has been mapped out primarily due to new technology by Pacific Biosciences (NASDAQ: PACB), also known as PacBio, who focus on long-read sequencing.

After a failed proposed merger in 2018 between these two companies due to scrutiny for monopolising the market, the deal was terminated in 2020. With these two companies operating independently, we ask which is the better buy?

Pacific Biosciences of California: Bull vs Bear arguments:

PacBio is an American biotechnology company that was founded in 2004 and went public in 2010. It claims to be a global leader in complete and accurate long-read genome sequencing, estimating its total addressable market in the region of $20 billion, leaving a significant runway for growth.

Last year PacBio released its Sequel IIe system, which followed on from the initial release in 2018 and was used to map the remaining 8% of the human genome. This new system has increased cost savings, fewer data storage needs, cloud enablement and is more accurate than other long-read alternatives. PacBio's technology is also gaining adoption by leading medical institutes and has made several partnerships with companies such as Invitae.

In addition, the company has a new management team which appears to be driving the success with CEO and former Illumina executive Christian Henry at the helm. Overall the majority of reviews on Glassdoor are positive, with a 4.3-star rating out of 5. This is a positive indication of the company culture at PacBio.

PacBio had the strongest Q1 in its history in 2021, driven by a record product and services revenue with total revenue increasing 86% year-over-year. The company also has a strong cash position with $1.16 billion in cash and investments.

It is also backed by SoftBank who announced a $900 million investment and, according to the PacBio CEO, "validates our leadership position in the long-read DNA sequencing market and enables us to further accelerate our growth". The stock has also been bought up by famed investor Cathie Wood's ARK Invest.

PacBio is unprofitable and recorded a net loss of $87 million compared to a net income of $1.3 million a year prior. Management stated that this is due primarily to the repayment of $52 million of Continuation Advances to Illumina in the first quarter of 2021 due to the investment by SoftBank. Pacbio also faces stiff competition from other more established players in the space, such as Illumina.

Illumina: Bull vs Bear arguments:

Illumina is an American company founded in 1998 and is a developer and manufacturer of life science tools for genetic variation analysis.

It is the market leader with roughly 75% market share in the genetic sequencing industry and has dominated the space for many years. The company has a track record of innovation that has allowed it to thrive, and with a rapidly expanding genome sequencing market, it should continue to. Illumina demonstrated its ability to adapt with COVID-19 and has worked with vaccine manufacturers while there are other long-term trends such as tracking future pathogens.

In Q1 of 2021, revenue grew by 27% year-over-year to $1.09 billion with a net income of $147 million and a gross margin of 70%. This was Illumina's first-ever billion-dollar revenue quarter in its history, driven by sequencing revenue that represented 90% of it. Management stated that its core business was "exceptionally strong". Due to its size, Illumina has significant financial firepower demonstrated by its $3 billion investment in research and development over the last five years.

The cost of genome sequencing has decreased significantly in recent years, but the stagnation of cost in short-read sequencing may pose a problem in the future. In addition, the increased use of long-read sequencing and its accuracy may pose a threat with competitors such as PacBio making strides in the space. There is also a question mark over its latest acquisition of GRAIL, although management expects the deal to go through.

So, which stock is a better buy right now?

Depending on the individual investor's appetite for risk, either company could be a good buy. I believe that PacBio offers a greater risk versus reward going forward and is a better buy due to its position in the rapidly evolving long-read genome sequencing market.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.