What Is A Better Investment Right Now: Palantir or C3.ai?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

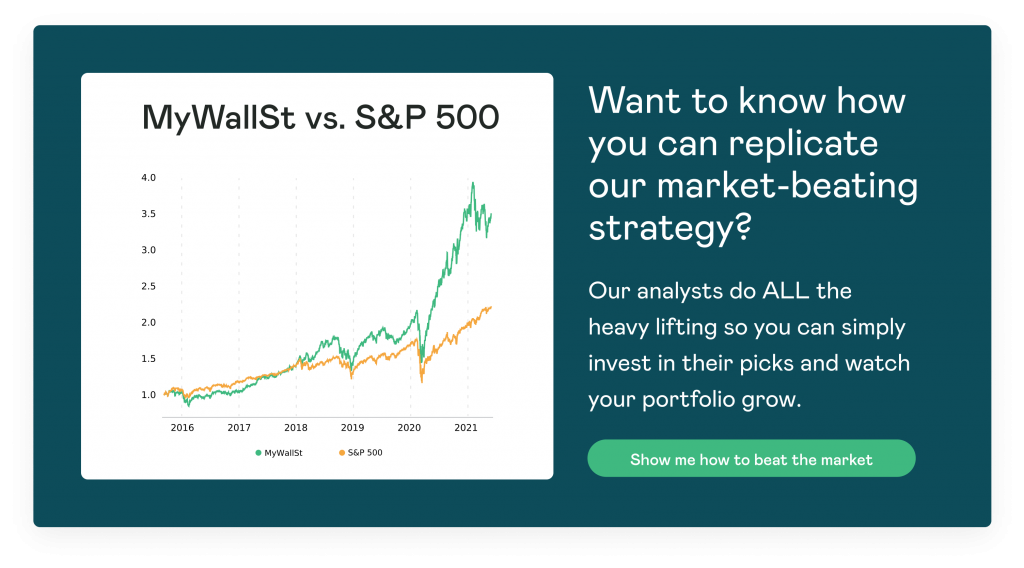

- Proven Success: 10-year track record of outperforming the market.

Both these companies enable organizations and government agencies to make better decisions through their platforms using artificial intelligence tools (AI). Both these companies' stocks shot up after going public and are now significantly down from their highs. But In a world increasingly powered by AI and data, we ask which stock is a better buy?

Palantir: Bull vs Bear arguments:

Palantir Technologies (NYSE: PLTR) operates two primary platforms, 'Palantir Gotham' and 'Palantir Foundry', used for data mining for governmental and commercial purposes respectively. The company currently has 149 customers with high-profile names such as the U.S. government and Amazon and an average contract value of $8.1 million. Palantir estimates that it has a total addressable market of $119 billion across these sectors.

It was co-founded by current chairman Peter Thiel, CEO Alex Karp, President Stephen Cohen, and two others. Karp has an 85% approval rating, and the company has 4.2 out of 5 stars which is satisfactory and a good indication of the company culture. It is also worth noting that the company's structure allows the founders and their affiliates to effectively control the company.

In Q1 2021, Palantir's revenue grew by 49% year-over-year to $341 million, with government and commercial revenue accounting for $208 and $132 million, respectively. Palantir also expects to be profitable this year which would be a significant change, and management is forecasting revenue growth of 30% or higher for the next four years.

Palantir has never turned a profit, and this may be a cause for concern for investors. In the latest quarter, its net loss widened to roughly $124.5 million and is trading at a rich valuation of roughly 35x price to sales.

Palantir has been involved in several controversies. One such example is its work with the National Health Service (NHS) in the U.K., which faced backlash and calls for the NHS to cut ties with the company. In addition, in the U.S., it faced criticism for its work with the government to locate and deport immigrants. Controversies like these may harm the commercial side if companies do not want to be associated with Palantir.

C3.ai: Bull vs Bear arguments:

C3.ai (NYSE: AI) is an enterprise software and (AI) provider and applications company. The company was founded in 2009 by current Chairman and CEO Thomas Siebel. Siebel has an impressive track record, having previously founded and sold Siebel Systems, a customer relationship management company.

C3.ai estimates its market opportunity will grow to $271 billion by 2024 at a compound annual growth rate of 12%. It is a first-mover in the Enterprise AI space giving it an advantage due to its investment in products and technology since it was founded. It delivers a staggering 1.6 billion predictions per day from its 4.8 million machine learning models.

The company is a platform-as-a-service (PaaS) business and generated $52.3 million in revenue in Q4, 2021, an increase of 26% YoY. Due to the nature of the business, revenue is highly predictable, with subscriptions making up 86% of revenue in the quarter. In addition, it has a high gross margin of 76%.

C3.ai employs a "lighthouse" strategy to attract new customers whereby it gains large global adapters that act as a proof of concept. This model has proven effective with large customers such as Shell, 3M, and the U.S. Air Force. Its customer base spans several industries and continues to increase, reporting a total of 89 customers in Q4, representing a growth of 82% YoY. It also reduces its reliance on larger customers, attracts small and medium businesses, and further diversifies its revenue stream.

However, the company is operating at a loss of $55.7 million in Q4, along with a rich valuation. Another risk to C3.ai is the large proportion of revenue coming from a handful of customers. In Q4, 57% of revenue was derived from four customers, and if it were to lose a customer, it would negatively impact the stock.

So, which stock is a better buy right now?

Palantir appears to be the better buy today due to its strong customer relationship, revenue forecasts, and because it is on track to turn a profit. However, at these sales multiples and from an ethical standpoint, I would be hesitant about investing.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.