What Is A Better Investment Right Now: Sally Beauty Or Ulta Beauty?

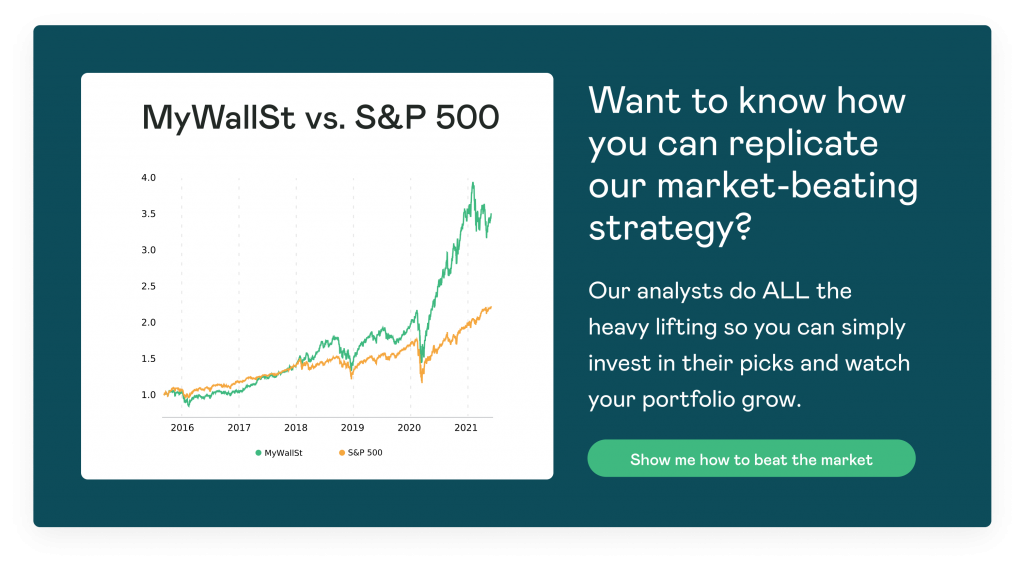

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

The Global Beauty and Personal Care Market continues to grow. Having been valued at $423 billion in 2020, it is expected to reach $558 billion, growing with a CAGR of 4.82%, by 2026. As a result of COVID-induced lockdowns being lifted, the value of beauty stocks has increased and investors all around the world are taking an interest. We investigate whether Sally Beauty or Ulta Beauty is a better investment at the moment.

Bull and bear case for Sally Beauty

American multinational Sally Beauty Holdings, Inc. (NYSE: SBH) specializes in the retailing and distribution of professional cosmetics supplies. Among its offerings include everything from hair coloring and skin care products to facial creams and nails art; all under one roof. With a global supply network and over 5,000 sites worldwide, including 141 franchises in the U.S., Latin America, and Europe, it is a major player.

The firm's operations were strong during its fiscal Q3, resulting in net sales of $1.02 billion, up 45% over the previous year's growth of 44%. In addition, the business reported $71 million in global e-commerce sales or 7% of total sales. It was also revealed that gross profit for the quarter was $514.4 million, up from $321.8 million a year earlier, a rise of 59%.

Chris Brickman, who just stepped down as CEO on October 1, stated in his press conference:

"The combination of improving macro factors in the U.S. and the easing of COVID-19 restrictions across our international territories drove net sales over $1 billion. Our top-line performance, coupled with ongoing strength in gross margin, resulted in significant growth in earnings."

However, the company is increasingly losing money. Sally Beauty had a net loss of $23.5 million, or $0.21 per diluted share as per its Q3 report. According to the company, the loss was caused by the global pandemic and slow recovery rate. Furthermore, negative media reports about the business's debt issues are spreading like wildfire, damaging the company's reputation.

Sally Beauty introduced 'SBH Going Green,' a company-wide program, in 2019 to reduce its environmental impact by reducing waste and energy usage throughout its supply chain and offices. Despite the fact that its share price has grown by just under 30% year-to-date (YTD), it would be prudent to monitor the company's future plans and its ongoing financial crisis.

Bull and bear case for Ulta Beauty

Ulta Beauty (NASDAQ: ULTA) is a chain of beauty boutiques across the U.S. that offers one-stop-shop solutions for all salon treatments. The company sells a wide range of cosmetics, perfumes, nail care, bath and body, and hair care items.

What makes selling beauty items different from selling clothes or electronics? Experience. Luckily, Ulta has plenty of this and is very good at indulging customers into feeling beautiful about themselves. Ulta combines the salon experience with the shopping experience; customers come in to get their hair and nails done by beauty professionals and leave with a bag full of new cosmetics. It is simply brilliant.

As of the last week of August, according to the firm's Q2 statistics, its net sales increased by 60.2% to $2 billion, up from $1.2 billion in the same period last year. There was a $798 million increase in gross profit for the firm compared to $329 million in the second quarter of 2020.

Dave Kimbell, Ulta's CEO stated:

"This performance reflects the recovery of the beauty category, investments and choices we've made over the last year to adapt to the market disruption and strengthen our leadership position, and the ongoing efforts of our associates to deliver great experiences for our guests."

Despite these impressive numbers, Ulta's had net losses of $70.5 million. This was expected as COVID-19 cases were continuing to spread across the U.S., not only putting people off in-store shopping but also dampening enthusiasm for social events.

So, which is a better investment?

With its global brand awareness and improved financial strategy, Ulta Beauty is unquestionably the better investment. Its recent earnings beat and heightened forecast have Ulta stock up 30% YTD, as of October 5. There is no doubt that Sally Beauty has a wider market and a global reputation, but its financial growth is limited.

Looking to diversify your portfolio with a beauty opportunity? Ulta Beauty seems like a fantastic long-term investment. Why not read more about it and other promising stocks in the MyWallSt app today. Simply click here to get free access.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.