What Is A Better Investment Right Now: Tesla or Volkswagen?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

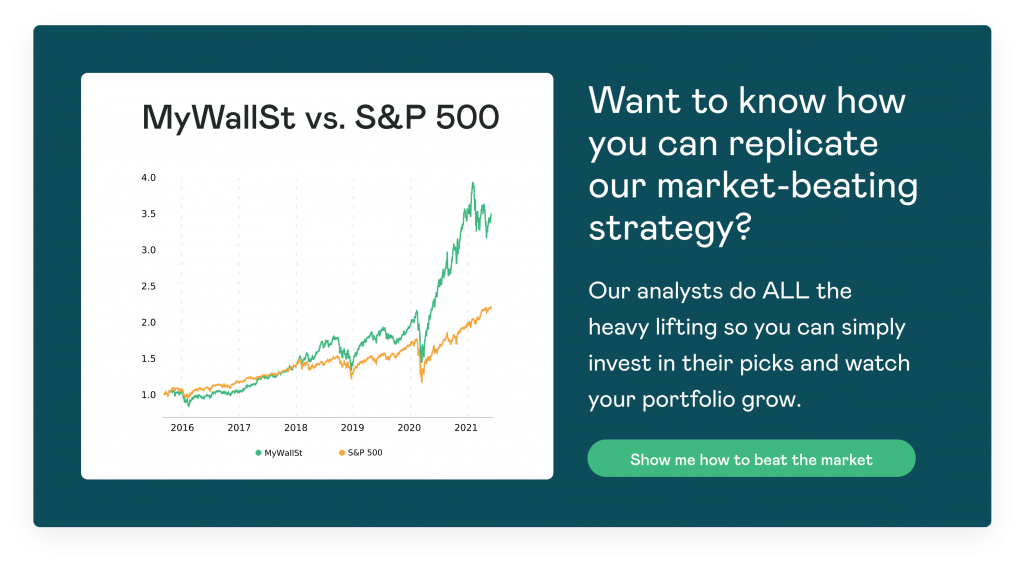

- Proven Success: 10-year track record of outperforming the market.

Volkswagen (OTCMKTS: VWAPY) is coming after Tesla (NASDAQ: TSLA) with all guns blazing as it pushes into the EV space by launching new factories and investing in battery innovation. However, Tesla, with its massive ongoing data mining, is in a prime position to optimize its autonomous vehicle (AV) tech and further expand its insurance offering. So, should you invest in Tesla or Volkswagen?

Bull for Tesla

If ever there was a time to back Tesla, it's now. The famous EV maker just reported a blowout quarter. In Q1, it delivered over 200,000 vehicles for the first time ever despite struggling with a chip shortage.

The company is predicting an annual growth of 50% in vehicle deliveries and is expecting to sell 5 million vehicles annually by 2030. With around 20% global market share and an expected EV penetration of 40%, it's not unreasonable to assume Tesla is the ultimate EV play.

Tesla also sells solar panels, battery storage, and will soon offer software packages for its AV offerings. Additionally, the company, with its extensive data on driver's habits, has started offering insurance and is projected to make $250 billion annually on insurance alone by 2030.

Tesla is doing all this while working on producing a cheaper vehicle and extending battery range. It is also building factories in Berlin, Austin, and another in Shanghai and will be launching its highly anticipated Cybertruck by the end of this year.

The firm also reached profitability from the sales of its vehicles and energy products in Q2 without relying on the selling emission credits, a new milestone for the company.

Bear case for Tesla

One concern for Tesla shareholders is Tesla's Bitcoin gamble which cost the company $23 million in Q2. If the cryptocurrency continues to fall, this could impact Tesla again in the future. With the coin being so volatile it's very hard for shareholders to decide how much this bet will cost the company.

Another worry for Tesla, and many other tech companies and manufacturers, is the global chip shortage. In the company's most recent earnings call, CEO Elon Musk also addressed chip shortage concerns, warning investors:

"For the rest of this year, our growth rates will be determined by the slowest part in our supply chain."

Growing tensions between Tesla and Chinese officials plus the delayed launch of its Model S sedan and Model X SUV are just some of the other concerns plaguing investors.

Volkswagen, for example, is planning on having 70 EV models for sale by 2030 and as one of the world's largest automakers, it can deliver on that ambition. Let us also not forget about new upstarts like Lucid Motors and NIO potentially taking market share from Tesla. And finally, there's Tesla's Technoking, Elon Musk, whom some investors are beginning to grow tired of due to his exaggerated claims and controversial Twitter rhetoric.

Bull case for Volkswagen

The European Union is striving towards carbon-neutrality by 2050 and Volkswagen is the company that is helping it get there. Already, the company has overtaken Tesla as EV market leader in Europe, with a 24% market share, compared to Tesla's 11%. Its future plans are also quite ambitious and include six battery cell factories by 2030, 18,000 charging stations in Europe, 3,500 in the U.S. and 17,000 in China by 2025.

Unlike Tesla, Volkswagen is one of the largest auto manufacturers in the world and can scale its factories to switch from combustion engines to battery-powered and thus produce more output. Its ID.3 model is cheaper than Tesla's Model 3 and was launched only in July of last year but quickly overtook sales from the legacy EV company.

Bear case for Volkswagen

The one area the company trails Tesla in is software, which Volkswagen will remedy with a $19 billion investment over the next five years. Tesla might have insurance as an additional revenue stream but Volkswagen has its Modularer E-Antriebs-Baukasten (MEB) platform, an efficient, flexible EV stage capable of scaling battery space. Already licensed to Ford, analysts are estimating that this tech will be worth $25 billion by 2028 in licensing agreements.

The same slew of competitors that Tesla is up against also pose a challenge to Volkswagen. Aside from this point against the company, the only other blemish faced by Volkswagen is from the 'Dieselgate' scandal of 2015, wherein the company intentionally programmed their vehicles to circumvent emissions standards. This might keep nervous investors away.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.