What Is A Direct Listing And Is It Better Than An IPO?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

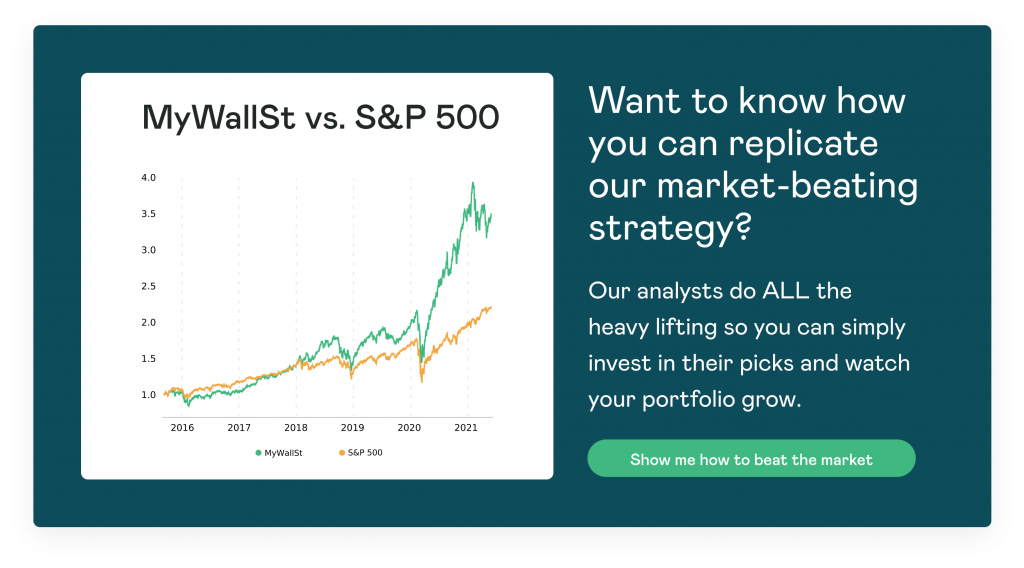

- Proven Success: 10-year track record of outperforming the market.

A Direct Listing or a Direct Public Offering (DPO), much like an IPO, refers to the process of a private company offering its shares on a publicly traded exchange. The concept of direct listing has been around for many years, with many companies going public this way. However, this method has gained in popularity in the last few years as several high-profile tech companies have opted to go public via a direct listing rather than a traditional IPO. The following article will explore the process, as well as the pros and cons, of going public via a direct listing.

How Does A DPO Work?

Traditionally, a DPO works differently from an IPO in many ways, with the main difference being that it does not create new shares for the public to buy. Instead, the company lists its already existing stock as available to buy from pre-existing shareholders, such as employees, executives, and company insiders.

Because the business does not need to create new shares, this means that the process is cheaper and quicker than a traditional IPO. The main cost-saving component is that the services of an underwriter are not required. Underwriters normally charge a commission in exchange for assuming a part of the financial risk of an IPO. Instead, a company going public via direct listing will only engage investment banks in an advisory capacity as they are not allowed to take any formal part in the process. The banks that assisted Spotify and Slack were paid $35 million and $22 million respectively.

Once the company is public, this creates liquidity for any pre-existing investors who want to sell their stock. With no lock-up period, they can immediately sell their stock should they wish. However, the market for its shares is purely based on its shareholders -- if no one wishes to sell, then no transactions can occur.

Pros & Cons of Direct Listings

Pros

- No lock-up period, this means that pre-existing investors can sell immediately. This also means that volatility down the line is less concentrated as it would be with an IPO'd company at the end of the lock-up period.

- Zero-to-low cost advantage. No expensive underwriters needed, who regularly charge up to 7% commission.

- A direct listing is a good alternative for a company that already has a large public presence, for example, Spotify and Slack.

- Also, this method is good for a company that does not have the funds needed to go through a traditional IPO.

Cons

- No publicity or the free advertising that an IPO can generate.

- Transactions can only occur if the shares held by employees or company insiders are sold in the first place. Plus, a limited number of shares can impact the chances of high growth in a short period of time.

- Higher chance of volatility in the short-term as the value of its shares is purely dependent on market demand.

- Raises little to no capital for the company as it cannot sell new shares, this method of going public is not ideal for a company that needs to raise capital.

Recent Developments

In 2020, the SEC approved a proposal by the New York Stock Exchange which allowed companies that go public via a DPO to also raise capital in the process. This presents a new facet to the DPO process whereby a company can go public, raise capital, and save money in the underwriting process.

To do this, the company can sell a set amount of shares which must all be sold in the opening auction at the same time, for the same price. Pre-existing shareholders can then choose to sell in the first auction if there is a demand for more than the allotted amount of new shares. Alternatively, they can wait until after the first auction has finished.

This new development provides a happy medium for many smaller companies that might choose to go public in the future. In addition, this is coming at a time where there is a high level of scrutiny over the traditional IPO process as many are complaining about its expensive nature and incorrect prices.

How should this affect investors?

Overall, direct listings do not present a different type of opportunity. Once the company is public it plays the same game as every other public company, although you could expect a bit more volatility in the short-term as well as less chance of high growth in a short period of time. However, this new development might encourage high growth opportunities for smaller companies that would do well in a publicly traded arena.

A MyWallSt subscription gives you access to over 100 market-beating stock picks and the research to back them up. Our analyst team post daily insights, subscriber-only podcasts and the headlines that move the market. Get your free access now!

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.