What is the Circle of Competence and How Do You Find Yours?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

Warren Buffett, Chairman and CEO of Berkshire Hathaway (NYSE: BRK.B), is often cited as one of the most successful investors ever to have walked the planet. When he speaks, people tend to listen. The 'Oracle of Omaha' is decidedly open about how he's achieved such rampant success and is happy to disclose his musings and strategies about finance and investing when called upon.

One famous idea from Buffett is one he coined the "circle of competence." This concept, developed by Buffett and his right-hand man Charlie Munger, is one of the guiding principles behind their success in investing and one that both men continue to espouse to this day. So, that begs the question...

What exactly is the Circle of Competence?

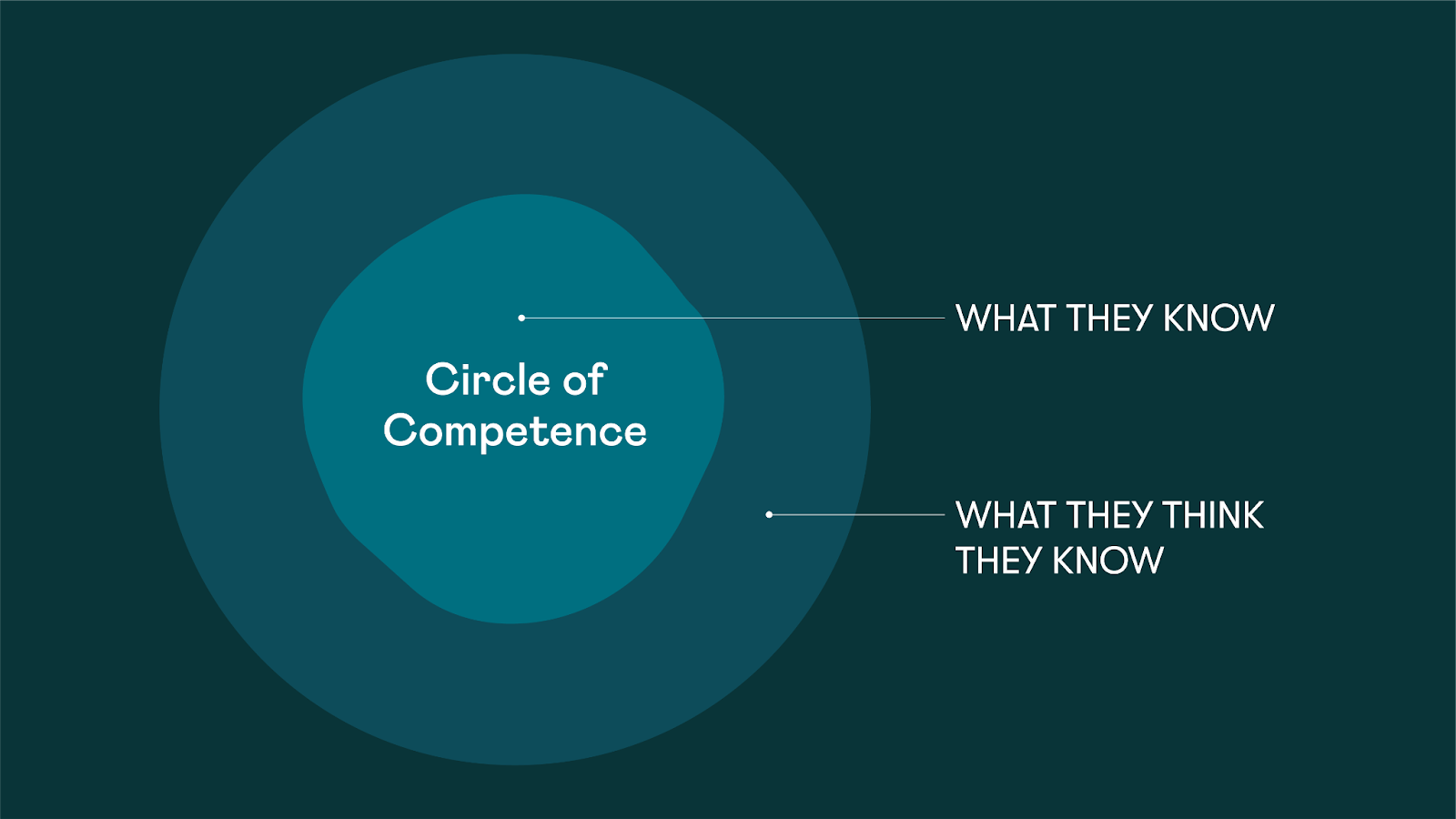

The Circle of Competence is a mental model that involves developing a knowledge of what specific areas an individual has an understanding of or experience in. Everyone has built up useful knowledge in some area of the world. By realizing where your strengths lie, you can determine the areas where you have very little familiarity and avoid them to mitigate risk.

In a 1996 letter to Berkshire Hathaway shareholders, Buffett expanded on the concept:

"What an investor needs is the ability to correctly evaluate selected businesses. Note that word 'selected': You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence."

Buffett and Munger built the Berkshire Hathaway empire by solely investing in businesses that they could understand. By leveraging their combined knowledge, the pair were able to make sure that they could be confident in any investments made through only investing within their respective circles of competence.

So, how do I find my Circle of Competence?

The most important thing when figuring out your own circle of competence is to be honest with yourself. As Buffett said, "the size of the circle is not very important." More important is defining the limits of your circle. Think of areas where you have an advantage over most people. This could be from study, work, or simply lived experience -- we all have a circle of competence.

For example, a lawyer who has spent decades studying and applying his knowledge in the courtroom will have a circle of competence rooted in law. It's highly specialized and offers a clear advantage to them when it comes to that area.

What experience and knowledge do you have that offers you an advantage over the average investor? Figuring this out and defining your circle is vital. As Charlie Munger put it:

"If you play games where other people have the aptitudes and you don't, you're going to lose. And that's as close to certain as any prediction that you can make."

So, if you're an avid gamer, perhaps investing in gaming companies would be wise. If you work as a software developer, maybe you'll be able to put that knowledge to use in picking software stocks that have massive potential upside. Conversely, this is the reason why, here at MyWallSt, we don't really look to invest in pharmaceutical stocks. Quite simply, it's outside of our circle of competence.

Once you've defined your circle of competence you can work on expanding it if you wish.

Why is having a Circle of Competence important?

The circle of competence offers many advantages to an investor, the chief among them being the avoidance of costly mistakes. Not every investment decision you make is going to work out perfectly, but by staying within your circle of competence you can lessen the risk for massive losses significantly. You enter every decision armed with knowledge and backed up by experience in that particular field. Both of these make decisions a lot more informed and easier to make.

The other advantage is the opportunity to turn your knowledge into results. By understanding your circle of competence, you can leverage this to make informed decisions about investments that others might not have the competence to make. If you double down on your strengths you will be poised to reap the rewards when a well-priced opportunity presents itself to you.

We'll leave you with one final thought from Charlie Munger,

"The whole trick of the game is to have a few times when you know something is better than average, and invest only where you have that extra knowledge. If that gets you a few opportunities, that's enough."

Couldn't have put it better ourselves.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.