What PayPal Gets Right About Acquisitions

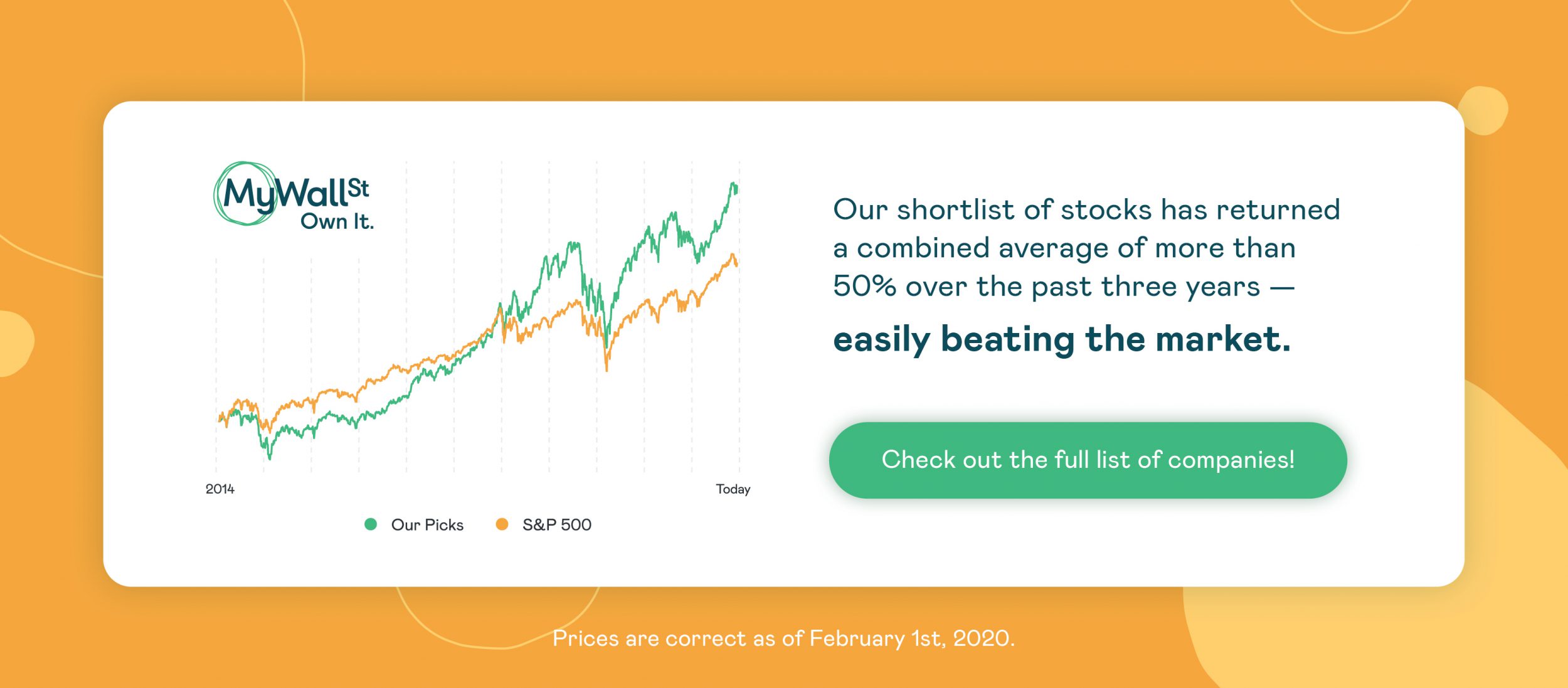

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

In November, payments giant PayPal (NASDAQ: PYPL) revealed that it will acquire Honey Science, the California-based technology company best known for its browser extension tool that allows online shoppers to find coupon codes. At $4 billion, the purchase will be PayPal's largest-ever acquisition.

It's not hard to see what made the startup so attractive to a company like PayPal. Though hardly a household name, Honey has built a very successful small brand centered around an often overlooked aspect of e-commerce -- finding coupons and promo codes -- and boasts some pretty impressive metrics to boot. The tool currently has roughly 17 million monthly active users (compared to 10 million a year ago) and works with 30,000 digital retailers around the globe. And unlike so many other young tech companies with high valuations, Honey is actually making money. Last year, the company generated an estimated $100 million in revenue and is on track to double that amount by the end of this year.

Perhaps the most appealing part of Honey's business from PayPal's perspective is its sophisticated data technology. The browser extension tracks virtually every stage of a shopper's journey towards the checkout page, including the research phase, whereas PayPal's tracking mechanism is mostly limited to the final stages of a purchase. Honey also wins points for its ethical approach to data, as it refrains both from selling user information and from tracking any browser history unrelated to retail.

As part of the acquisition, it appears that Honey will continue to operate under its own brand identity instead of being absorbed into the PayPal family. This is in line with the payments company's broader buying strategy, which typically involves "bolting" new acquisitions onto its core brand rather than trying to integrate them seamlessly. The strategy has been a great success so far for PayPal. The same can't be said for Eventbrite's (NYSE: EB) ill-fated merger with Ticketfly, to take a recent example.

Indeed, with more than 20 companies under its belt, PayPal's acquisition history merits a closer look. Prior to the Honey purchase, the firm's largest acquisition came about last year, when it bought Swedish fintech company, iZettle, for $2.2 billion. The company, which specializes in providing financial tools to smaller businesses, is often referred to as Europe's answer to Square (NYSE: SQ), the mobile payments company founded in 2009 by Twitter's Jack Dorsey. Practically from day one, Square's simple point of sale systems and payment processors proved extremely popular with small-time vendors and businesses, especially in the U.S. However, iZettle's presence in several European markets allowed PayPal to push back against its younger competitor on both sides of the Atlantic.

The deal has resulted in some minor difficulties for PayPal, including a slap-on-the-wrist antitrust fine from a UK watchdog back in September, but overall, it has proved valuable for the company. Around the time of the iZettle buyout, PayPal completed a $400 million acquisition of payout platform HyperWallet, collectively adding almost 3 million accounts to the company's platform as well as deepening its global presence.

Of all PayPal's acquisitions, perhaps the most famous so far has been Venmo, the millennial-friendly payment app originally developed by startup Braintree. The acquisition was finalized in 2013 and cost the company a cool $800 million. The bet is paying off, however. Last year alone, the app processed over $62 billion in transactions, representing a full 79% jump from the year before. Meanwhile, it's set to pull in $200 million in revenue by the end of the year. One of the PayPal's best moves regarding the takeover was not to interfere needlessly with the Venmo brand, which was already held in high-esteem by younger users and might easily have been tainted by association with the older company (the exact opposite of a certain social media company's recent tactics with its family of apps). Indeed, one report at the time had the following unimprovable headline: "PayPal Is Okay If Millennials Don't Know It Owns Venmo."

This hands-off approach has been one of the most noteworthy qualities of the Venmo, iZettle, and HyperWallet acquisitions, along with many others throughout PayPal's history. Concerned above all in increasing its access to new markets and better user data, the payments giant has managed to retain its own iconic status while simultaneously respecting the new apps and tools that come under its wing. PayPal has given the same assurance to Honey Science, proving that you can never have too much of a good thing.

MyWallSt operates a full disclosure policy. MyWallSt staff currently hold long positions in Eventbrite, PayPal, and Square. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.