What Should Be My First Stock Investment?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

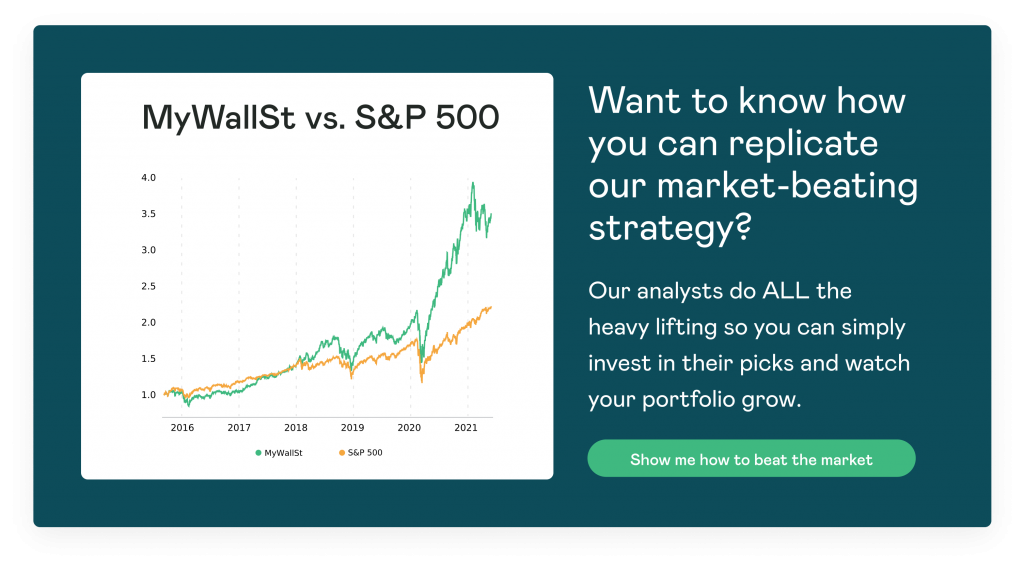

- Proven Success: 10-year track record of outperforming the market.

So many early investors feel like they need to wait for the right time to get into the market. Everyone fears the next downturn and there is a constant worry that the day they buy their first stock will be the day that everything will come crashing down.

The great thing about this problem is that it's actually a pretty easy thing to fix.

Step 1: Don't worry and invest when you have the money to do so.

And that's it. Always remember this when you feel the need to hold back or wait and see:

Time in the market is a lot more important than timing the market.

The reason you shouldn't worry about timing the market is a fairly simple one. You can't. No one can. Not even the greatest financial scholar or the highest paid Wall Street advisor.

If you listen to the talking heads and stock advisors, you'll often hear them talking about a good time to buy or sell. This usually happens after the company has had some major news or released a quarter's earnings report.

These kinds of events usually shake the price of a stock around a bit - leading the speculators to swoop in to try and make a quick buck. Over the long run, these minor movements will have very little effect on your investment.

Your first stock should be a company that you love and believe in. It should be one that you're going to enjoy reading about and watching grow over the many years you intend to own it.

We recommend you choose a large-cap bedrock for your first investment. Think about companies like Google, Amazon, Disney or Starbucks. These companies aren't going anywhere any time soon. They are good stocks to build your portfolio on before you start to diversify with smaller companies.

If you want to start investing, MyWallSt's got you covered with a shortlist of market-beating stocks, so you too can accumulate long-term wealth. Simply click here for free access today.

TL;DR

- No one can time the market, so don't bother trying.

- Invest when you have the funds to do so in a company you will enjoy following.

- Large-cap bedrocks are a safe first investment to get you started.

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.