Why Is Aritzia So Popular?

Join thousands of savvy investors and get:

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.

Say hello to the next queen of cool...

If you've recently ventured out into the world, you will notice an explosion of puffer coats. Suddenly, everyone is dressed like Ernest Shackleton off to the Antarctic despite the fact all they're really doing is getting a cup of coffee and pretending to look interesting. When thinking about this trend, there are two brands that come to your mind: The North Face and Canada Goose. I know you're thinking these because both love to have their branding displayed prominently like a kind of socio-economic Hogwarts crest. But there is actually a third puffer coat brand quietly making its way across Canada and the United States.

It's called The Super Puff and is one of the many in-house brands produced by the Canadian clothing company Aritzia. If you see an upper-middle-class woman in New York City donning a puffer coat without a logo, it is undoubtedly a Super Puff. The $400 down-filled jackets have become a must in any cold-weather cultural center. But it's not just The Super Puff that has women flocking to Aritzia, it's all of their various wares.

Aritzia was founded in Vancouver, Canada in 1984 by Brian and Ross Hill, they are the children of Jim Hill, the founder of the luxury retail company Hills of Kerrisdale. The pair wanted to create a unique boutique experience for women that would fill the gap between luxury clothing retailers for adults and trendy retailers for teenagers (sound familiar?)

However, the Hills couldn't find brands that fit this mold so they decided to create their own. Aritzia has twelve in-house brands that design and manufacture all their own products and they represent 95% of the company's sales. This vertical integration allows Aritzia to adapt to changing trends without sacrificing quality. It describes itself as "mid-priced luxury fashion" and has become an answer to fast fashion. Think of it as the place to get high-quality staples, like sweatshirts, dresses, and blouses, for a reasonable price. Its trendy, unique locations are certainly a selling point (not unlike other Canadian darling Lululemon) but its online presence is nothing at which to laugh. E-commerce sales typically represent 33% of revenue.

This model is working and Aritzia is booming. The company now has 105 locations scattered throughout affluent parts of North America and sales are flowing. Last quarter, Aritzia saw revenue jump 50.1% while comparable sales were up 28.3%, in the United States revenue increased 79.8%. All the while, our old friend vertical integration has given the business a gross margin of 44% and an EBITDA margin of 16%.

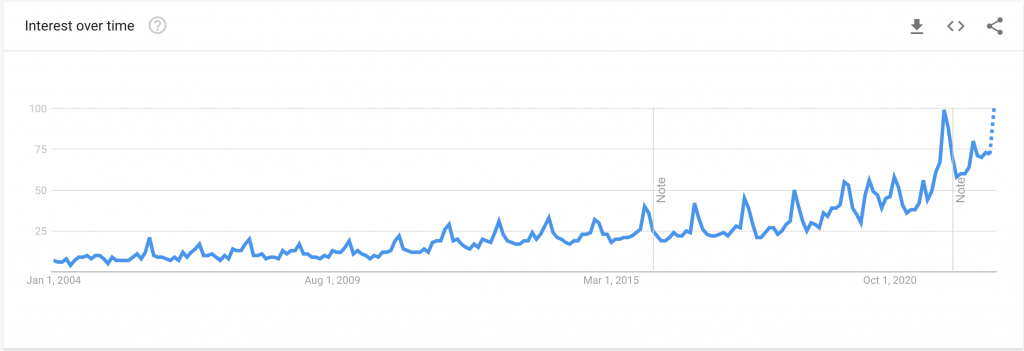

If we take a look at this Google trends analysis, clearly word is getting around:

Right now, its stock trades on the Canadian exchange (TSE: ATZ) for an eye-watering price-to-earnings of 39, just behind Lululmeon with a PE of 42. However, I can't take my eyes off it.

Non-athletic clothing stocks have always been a challenge, all great giants must eventually fall but there's something to be said for a brand that was born with the ability to be flexible. Aritzia has become synonymous with quality, not a specific style, and is incredibly adaptable. This may just grant it an advantage in the race for closet space and allow it to hold on to the slippery title of cool.

- Weekly Stock Picks: Handpicked from 60,000 global options.

- Ten Must-Have Stocks: Essential picks to hold until 2034.

- Exclusive Stock Library: In-depth analysis of 60 top stocks.

- Proven Success: 10-year track record of outperforming the market.