The sector was trading at roughly the same valuation of the broader market in 2011, in terms of price to book (P/B) ratio. Currently, it trades at a P/B of 1.5x as compared to the 3.5x of the S&P 500. The substantial drop in oil prices plays a major role in the underperformance of the sector. The price of Brent Crude stood at $120 per barrel in 2011, it stands at $64.83 as of 14TH January 2020.

Brent Crude

The energy sector was suffering the same fate. The iShares S&P Global Energy Sector ETF (NYSEARCA: IXC) which traded at $44 in 2011, now trades at $30. Some investors who feel there is too much value in the sector have started buying in because prices are too cheap considering their valuations, higher cash flows, and dividend growth. The recent rotation into value from growth has also fuelled this short rally in energy. Additionally, there is a bullish sentiment on the 2020 earnings for energy stocks as oil prices are expected to nudge higher due to prevailing tensions between U.S. and Iran and supply cuts by OPEC. Thomas Hayes, chairman of New York-based hedge fund, Great Hill Capital said earnings are expected to grow by 23% more than that of Industrials at 17% and materials at 15%.

The sector consists of different types of participants like oil and gas drilling and production, pipeline and refining, electricity and natural gas, mining companies, renewable energy and chemicals. Each one of these sub-segments plays a distinct role in bringing energy to the end consumer. Where some companies specialize in one of these segments, bigger giants like Chevron (NYSE: CVX) and Exxon (NYSE: XOM) participate throughout the supply chain.

Hayes had a strong bullish case for explorers and producers such as EOG Resources (NYSE: EOG), Pioneer Natural Resources (NYSE: PXD), ConocoPhillips (NYSE: COP), Concho Resources (NYSE: CXO) and Occidental Petroleum (NYSE: OXY) as OPEC+ committed more production cuts and as the U.S. president delayed the 15th December tariffs on China. Warren Buffet committed $10 billion to the Anadarko bid by Occidental Petroleum. Carl Icahn had $5.6 billion invested in energy stocks by the end of 2019, which included big holdings in Occidental, CVR Energy (NYSE: CVI) and Cheniere Energy (NYSE: LNG).

Moving into 2020, there are a few challenges for the energy giants. Climate change is one, which is driving massive investment into renewable energy sources like Solar, Wind, Hydropower etc. Some of the bigger players in the renewable energy industry have done relatively well, Solaredge Tech (NASDAQ: SEDG), up 177.4%, Enphase Technologies (NASDAQ: ENPH) up 351%, SMA solar, up 118.6%, FirstSolar (NASDAQ: FSLR) up 15.8% and Canadian Solar (NASDAQ: CSIQ) up 28.1%, are a few examples.

While lower valuations and increased production cuts have led to positive sentiment in the sector, it's important to watch how the industry positions itself around the growing renewable energy segment. Other than that, energy demand and supply is the most important factor. In 2019, OPEC took several measures to cut down production to compress supply in an effort to keep the oil price rising, but the U.S. has done everything to keep the oil prices low. Lastly, China - the biggest importer of oil -- is struggling with the trade war and tariffs from the U.S. The phase one deal has now been signed, but hopefully, phase two will give us a much better view on how the dynamics are going to change for LNG and oil exporters in the U.S.

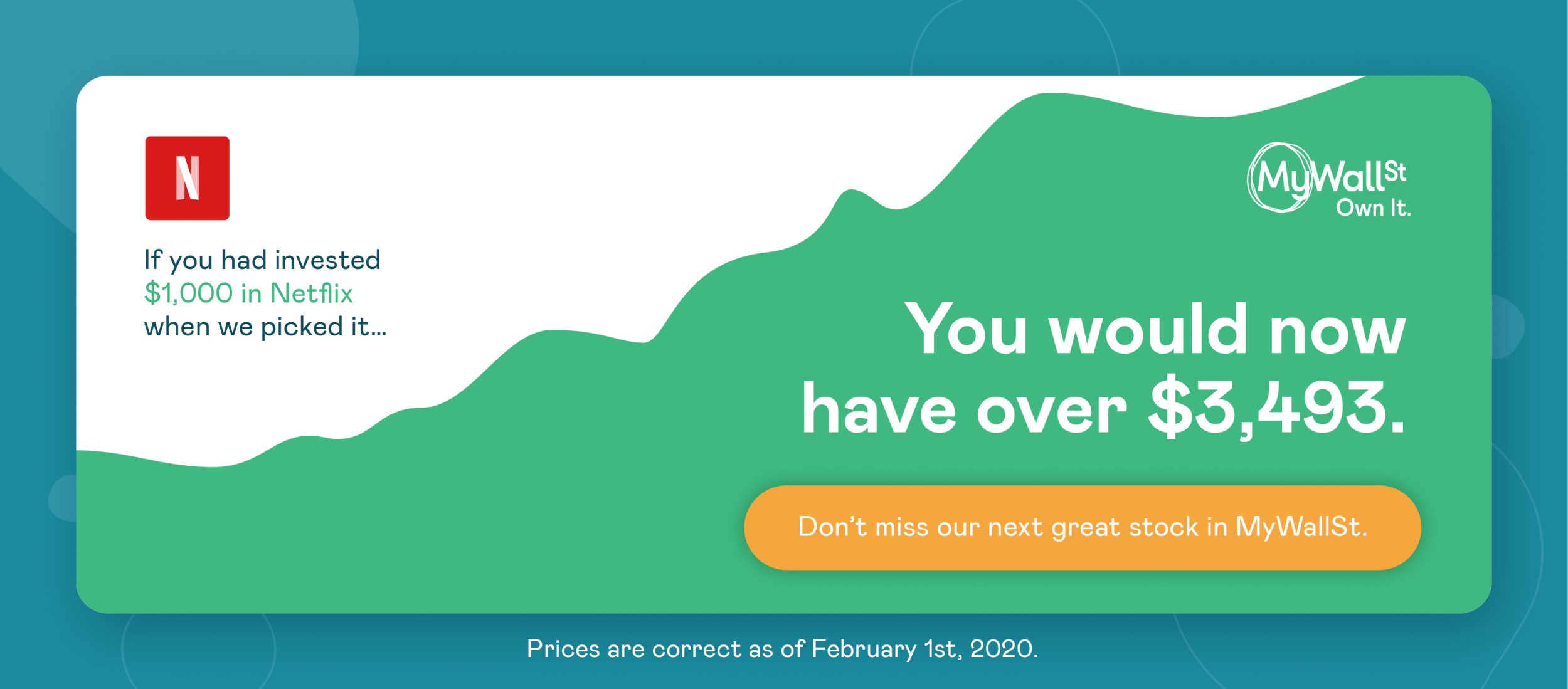

MyWallSt operates a full disclosure policy. MyWallSt staff currently holds long positions in companies mentioned above. Read our full disclosure policy here.

- New stock picked every week out of 60,000 worldwide

- Ten Foundational stocks to hold until 2034

- A library of 60 stocks with analysis

- 10 year Track record of performance