What to Watch

- Artificial Intelligence - AI is the hot topic right now, and through its stake in OpenAI, Microsoft has taken a commanding position in the race. While ChatGPT may make all the headlines — and even make Bing a plausible competitor to Google Search — management has plans to integrate generative AI capabilities across its product suite, most prominently in Github and Office.

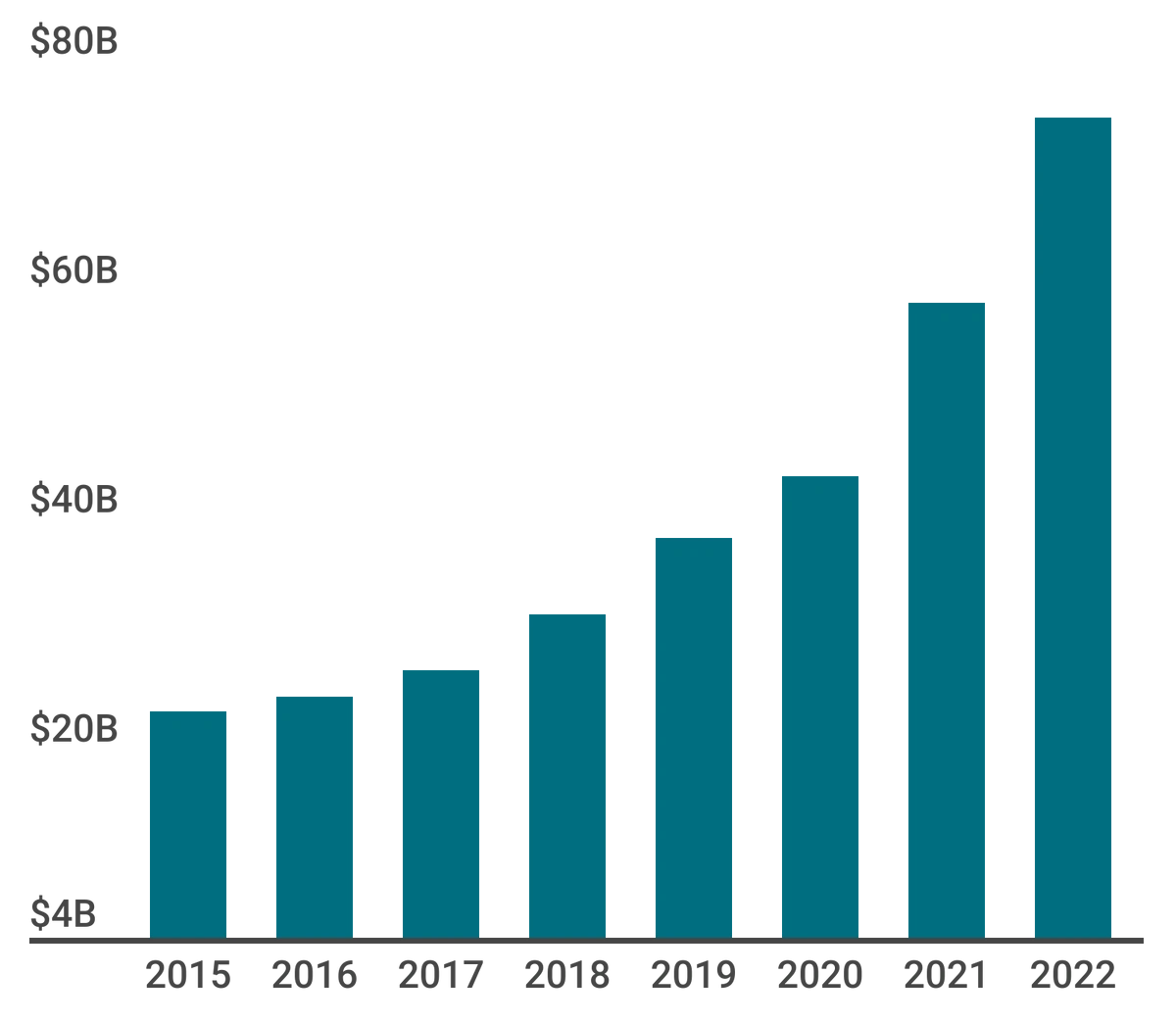

- Leadership - Satya Nadella took over as CEO from Steve Ballmer in 2014 and the turnaround the company has seen since is second-to-none. His leadership has propelled the company to new heights and is a key factor for our investment thesis.

- M&A - Acquisitions have been a key strategy of Nadella’s in his tenure at the helm of Microsoft. Blockbuster deals saw it takeover LinkedIn, Github, Activision Blizzard (pending approval), and a significant stake in OpenAI. Watch this space.