What to Watch

-

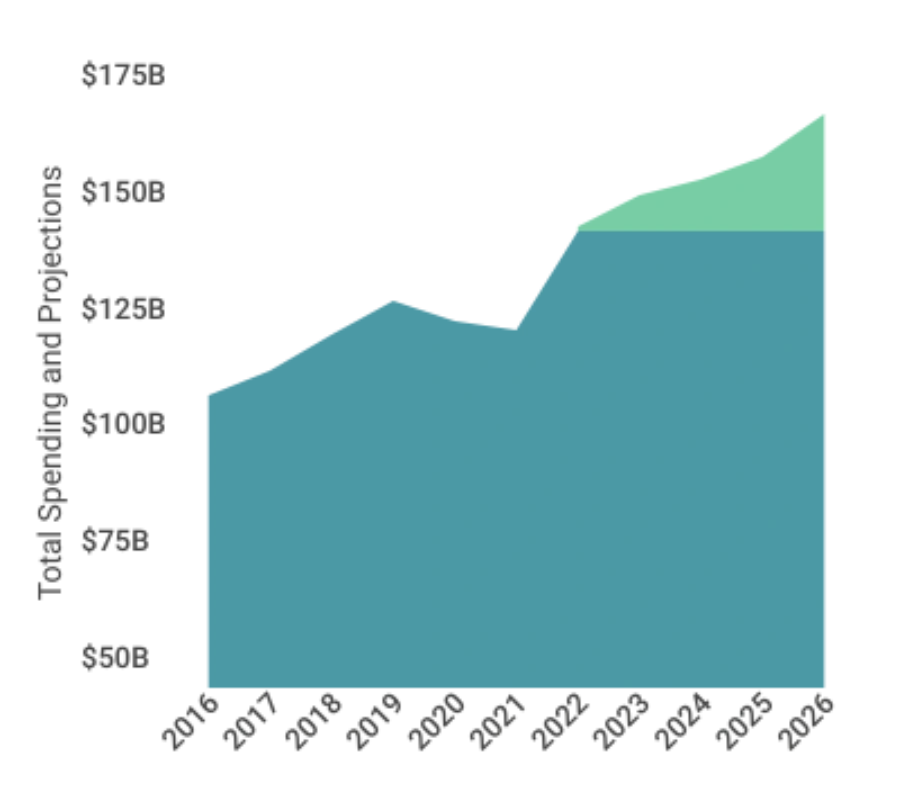

Aging Infrastructure - According to Core & Main, the average age of water and wastewater pipes in 2020 was 45 years, up from 25 in 1970. Add to this over 600 municipalities still use 200-year old cast iron pipe systems. It estimates that over $2 trillion will be needed to repair and upgrade water infrastructure in the U.S.

-

M&A - Core & Main’s main source of growth comes from acquisitions, a riskier strategy than investing in organic growth, but one it has been making work. By performing accretive, bolt-on acquisitions that allow it to easily and quickly expand its geographic footprint, it can avail of new income streams while concurrently achieving cost savings.

-

Cyclicality - Core & Main operates in a cyclical industry, meaning it usually moves in tandem with the wider economy. This can make it more volatile than other stocks.